101 Ways to Master the Rule of 72: Double Your Money with Compound Interest in 2025

101 Ways to Master the Rule of 72: Double Your Money with Compound Interest in 2025

Introduction

Imagine knowing exactly how long it will take to double your money — without complicated calculations or financial software. That’s the power of the Rule of 72, one of finance’s most elegant shortcuts. This simple formula has helped countless investors make smarter decisions about their money for generations.

In the rapidly evolving financial landscape of 2025, understanding the Rule of 72 is more crucial than ever. With inflation concerns, diverse investment opportunities, and the rise of digital assets, knowing how to project your wealth growth gives you a significant advantage. Whether you’re a beginner taking your first steps into investing or an experienced investor refining your strategy, the Rule of 72 remains an indispensable tool in your financial arsenal.

This comprehensive guide unveils 101 practical ways to leverage the Rule of 72, transforming how you think about compound interest and wealth building. From traditional investments to modern opportunities, you’ll discover actionable strategies that can help you achieve your financial goals faster and more confidently.

Objectives

By the end of this guide, you will:

- Master the Rule of 72 and perform quick mental calculations to estimate investment growth

- Apply the formula across various investment vehicles, including stocks, bonds, real estate, and cryptocurrencies

- Identify optimal investment strategies that align with your financial timeline and risk tolerance

- Avoid common pitfalls that sabotage wealth accumulation

- Develop a personalized action plan to double your money strategically

- Understand the relationship between risk, return, and time in wealth building

What is the Rule of 72?

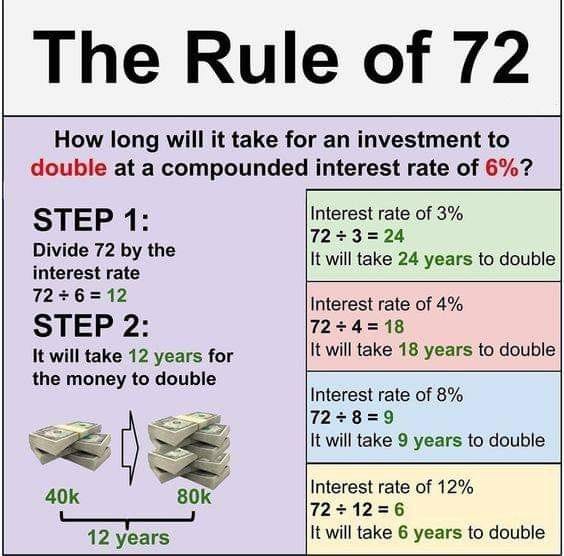

The Rule of 72 is a straightforward formula that estimates how many years it will take for an investment to double at a fixed annual rate of return:

Years to Double = 72 ÷ Annual Interest Rate

For example:

- At 8% annual return: 72 ÷ 8 = 9 years to double your money

- At 6% annual return: 72 ÷ 6 = 12 years to double your money

- At 10% annual return: 72 ÷ 10 = 7.2 years to double your money

This elegant formula works because of the mathematical properties of compound interest, providing remarkably accurate results for interest rates between 6% and 10%.

Importance of Understanding the Rule of 72

1. Instant Financial Clarity

No calculators, spreadsheets, or apps needed. You can evaluate investment opportunities on the spot, making informed decisions quickly and confidently.

2. Goal-Setting Precision

When you know your money will double in X years, you can backward-engineer your financial goals. Need $100,000 for a down payment in 10 years? Start with $50,000 at a 7.2% return.

3. Inflation Awareness

The Rule of 72 works in reverse, too. At 3% inflation, your purchasing power halves every 24 years. This reality check motivates smarter investing to stay ahead of inflation.

4. Comparative Analysis

Quickly compare different investment opportunities. Is a 9% return worth the extra risk compared to a safer 6% option? The Rule of 72 shows you the time difference clearly.

5. Compound Interest Appreciation

Seeing how quickly (or slowly) money doubles helps you truly grasp the power of compound interest and the cost of delayed investing.

Purpose of This Guide

This guide serves multiple purposes:

- Educational: Demystify compound interest and make advanced financial concepts accessible to everyone

- Practical: Provide actionable strategies you can implement immediately

- Inspirational: Motivate consistent, disciplined investing habits

- Comprehensive: Cover diverse investment approaches suited for different risk profiles and life stages

Overview of Profitable Earnings Potential

Historical Returns Context

Understanding realistic expectations is crucial:

- S&P 500 Historical Average: Approximately 10% annually over the long term (70+ years)

- Bond Market Average: Typically 4–6% for investment-grade bonds

- Real Estate: Often 8–12% including appreciation and rental income

- High-Yield Savings (2025): Around 4–5% in competitive markets

- Conservative Portfolio: Generally 5–7% with balanced allocation

Doubling Scenarios

Let’s examine what these returns mean using the Rule of 72:

$10,000 Initial Investment

- At 6% (conservative): Doubles to $20,000 in 12 years

- At 9% (moderate): Doubles to $20,000 in 8 years

- At 12% (aggressive): Doubles to $20,000 in 6 years

$50,000 Initial Investment

- At 7%: $100,000 in approximately 10 years, $200,000 in 20 years, $400,000 in 30 years

- At 10%: $100,000 in approximately 7 years, $200,000 in 14 years, $400,000 in 21 years

The power of compound interest becomes truly remarkable over extended periods. Starting early and maintaining consistency dramatically amplifies results.

101 Ways to Apply the Rule of 72

Understanding & Calculation (Ways 1–10)

- Master the basic formula: Commit “72 ÷ interest rate” to memory

- Calculate doubling time: Practice with different rates until it becomes second nature

- Work backwards: Determine the required return rate to double money in your target timeframe

- Account for fees: Subtract annual fees from return rates for accurate calculations

- Consider taxes: Use after-tax returns for realistic projections

- Adjust for inflation: Calculate real returns by subtracting inflation from nominal returns

- Use the Rule of 70: For continuously compounded interest, use 70 instead for slightly more accuracy

- Apply the Rule of 69: For precise calculations with continuous compounding

- Triple your money: Use 115 ÷ interest rate to estimate tripling time

- Quadruple your money: Simply double the doubling time for a 4x return

Stock Market Strategies (Ways 11–25)

- Index fund investing: Target 10% average returns through broad market exposure

- Dividend growth stocks: Combine appreciation with reinvested dividends

- Dollar-cost averaging: Invest consistently regardless of market conditions

- Blue-chip stocks: Focus on established companies with steady growth

- Sector rotation: Shift between industries based on economic cycles

- Growth stock allocation: Accept higher risk for potentially faster doubling

- Value investing: Buy undervalued stocks for long-term appreciation

- International diversification: Capture growth in emerging markets

- Small-cap exposure: Higher volatility but potentially superior returns

- Reinvest dividends: Accelerate doubling through automatic reinvestment

- Tax-loss harvesting: Offset gains to improve net returns

- Avoid emotional trading: Stay disciplined to capture long-term averages

- Minimize trading costs: Every fee eats into your doubling time

- Rebalance annually: Maintain target allocation for optimal risk-adjusted returns

- Use ETFs strategically: Low-cost exposure to diverse strategies

Real Estate Applications (Ways 26–35)

- Rental properties: Generate cash flow while properties appreciate

- REITs: Invest in real estate without property management

- House hacking: Live in one unit, rent others to accelerate equity building

- Real estate crowdfunding: Access commercial properties with smaller capital

- Fix-and-flip: Higher risk but potential for rapid value doubling

- Mortgage paydown: Equity grows as principal decreases

- Appreciation zones: Research high-growth markets for faster doubling

- Commercial properties: Often higher yields than residential

- Vacation rentals: Premium rental rates in tourist destinations

- Land banking: Hold undeveloped land in growth corridors

Retirement Accounts (Ways 36–45)

- 401(k) maximization: Capture full employer match for instant returns

- Roth IRA contributions: Tax-free growth compounds faster

- Traditional IRA: Tax-deferred compounding accelerates doubling

- SEP IRA for self-employed: Higher contribution limits mean faster growth

- Target-date funds: Age-appropriate allocation optimizes risk-return

- Avoid early withdrawals: Preserve compounding momentum

- Backdoor Roth: High earners can still access Roth benefits

- Mega backdoor Roth: Maximize after-tax contributions

- HSA triple advantage: Tax-deductible, tax-free growth, tax-free withdrawals for medical

- Required minimum distributions: Plan for withdrawals without disrupting the doubling

Fixed Income & Bonds (Ways 46–55)

- Bond ladders: Stagger maturities for liquidity and returns

- Corporate bonds: Higher yields than government bonds

- Municipal bonds: Tax-free interest for high earners

- High-yield bonds: Carefully selected junk bonds offer superior returns

- Treasury Inflation-Protected Securities: Preserve purchasing power

- Savings bonds: Safe, guaranteed returns for conservative investors

- Bond funds: Diversified fixed-income exposure

- International bonds: Currency appreciation adds return potential

- Floating-rate bonds: Adjust with interest rates

- Zero-coupon bonds: Deep discount provides a known doubling timeline

Alternative Investments (Ways 56–70)

- Peer-to-peer lending: Direct loans to borrowers at attractive rates

- Cryptocurrency allocation: Small position for asymmetric upside potential

- Precious metals: Hedge against currency devaluation

- Commodities: Diversification and inflation protection

- Private equity: Access to non-public company growth

- Angel investing: High risk but exponential return potential

- Collectibles: Rare items appreciate over time

- Fine art: Cultural assets with appreciation potential

- Venture capital funds: Portfolio approach to startup investing

- Farmland: Tangible asset with food production income

- Timberland: Long-term appreciation with harvesting income

- Royalties: Music, patent, or mineral rights generate passive income

- Business ownership: Direct control over return generation

- Franchise investments: Proven business model with support

- Intellectual property: Create and license valuable content

Risk Management (Ways 71–80)

- Diversify across asset classes: Reduce single-investment risk

- Understand your risk tolerance: Match investments to comfort level

- Emergency fund first: Never invest money needed short-term

- Insurance protection: Protect wealth from catastrophic loss

- Avoid get-rich-quick schemes: Unrealistic returns signal danger

- Due diligence: Research thoroughly before investing

- Professional advice: Consult financial advisors for complex situations

- Regular portfolio reviews: Ensure alignment with goals

- Stop-loss disciplines: Protect against severe downturns

- Position sizing: Limit exposure to any single investment

Tax Optimization (Ways 81–88)

- Tax-advantaged accounts: Prioritize 401(k), IRA, HSA contributions

- Tax-loss harvesting: Offset gains with strategic losses

- Long-term capital gains: Hold investments over one year for preferential rates

- Qualified dividends: Structure for lower tax rates

- Estate planning: Minimize taxes on wealth transfer

- Charitable giving: Donate appreciated assets for deductions

- Tax-efficient fund placement: Bonds in IRA, stocks in taxable accounts

- State tax considerations: Some states have no income tax

Behavioral & Mindset (Ways 89–98)

- Start immediately: Time in market beats timing the market

- Automate contributions: Remove emotion from investing

- Ignore market noise: Focus on long-term averages

- Patience and discipline: Compounding requires time

- Continuous education: Stay informed about opportunities

- Avoid lifestyle inflation: Invest raises and bonuses

- Set clear goals: Know what you’re doubling money for

- Track progress: Regular reviews maintain motivation

- Celebrate milestones: Acknowledge progress toward doubling

- Learn from mistakes: Adjust strategy based on experience

Advanced Strategies (Ways 99–101)

- Leverage intelligently: Carefully used debt can accelerate doubling (with risk)

- Options strategies: Covered calls generate additional income on holdings

- Business reinvestment: Plow profits back into high-return ventures

Pros of Using the Rule of 72

Advantages

Simplicity and Speed: No complex calculations required. You can evaluate investments mentally during conversations, meetings, or while reviewing opportunities.

Universal Application Works across virtually all investment types — stocks, bonds, real estate, savings accounts, and more. One formula, endless uses.

Goal-Setting Foundation provides clear timelines for financial objectives. Knowing you need a 9% return to double money in 8 years creates actionable targets.

Inflation Reality Check quickly shows how inflation erodes purchasing power, motivating proactive wealth protection strategies.

Investment Comparison makes apples-to-apples comparisons effortless. Instantly see that 12% versus 8% means doubling in 6 years instead of 9 — a 33% time difference.

Educational Value: Teaches compound interest intuitively without intimidating mathematics. Perfect for beginners building financial literacy.

Risk-Return Awareness: Higher returns (faster doubling) always come with trade-offs. The Rule of 72 helps visualize these relationships.

Cons and Limitations

Disadvantages

Accuracy Limitations: Most accurate between 6–10% returns. At extremely high or low rates, the approximation breaks down somewhat.

Oversimplification: Real investments fluctuate. The Rule of 72 assumes steady, consistent returns that rarely occur in reality.

Ignores Contributions Only calculates doubling on the initial investment. Doesn’t account for regular additional contributions that dramatically accelerate growth.

Tax and Fee Blindness The basic formula doesn’t incorporate taxes, fees, or expenses that reduce actual returns.

No Risk Assessment doesn’t evaluate the probability of achieving projected returns or the volatility involved.

Inflation Confusion: Users must remember to distinguish between nominal and real (inflation-adjusted) returns.

Behavioral Gaps Knowing money should double in 9 years doesn’t help if you panic-sell during a market correction.

False Precision The ease of calculation can create false confidence in projections based on uncertain future returns.

Professional Advice & Suggestions

Expert Recommendations

Start with the Basics. Before pursuing aggressive doubling strategies, ensure you have:

- An emergency fund covering 3–6 months of expenses

- High-interest debt paid off (credit cards, personal loans)

- Adequate insurance protection (health, life, disability)

- Clear financial goals with specific timelines

Embrace Realistic Expectations. Be skeptical of investments promising returns much higher than historical market averages. If someone guarantees 20%+ returns with “no risk,” it’s likely fraudulent.

The Time Factor is Critical.l Starting early is more valuable than finding the perfect investment. A 25-year-old investing $5,000 annually at 8% accumulates significantly more than a 35-year-old investing $10,000 annually at the same rate.

Diversification isn’t Optional. Never bet everything on a single investment, no matter how confident you feel. Spread risk across different asset classes, geographic regions, and investment types.

Match Strategy to Life Stage

Your 20s-30s: Aggressive growth focus, higher stock allocation, longer time horizon allows recovery from volatility

Your 40s-50s: Balanced approach, gradually increasing fixed income, protecting accumulated wealth while still growing

Your 60s+: Capital preservation priority, income generation, reducing volatility as you approach or enter retirement

Understand Real vs. Nominal Returns. A 7% return sounds great until you realize 3% inflation means your purchasing power only grows at 4%. Always calculate real returns for accurate planning.

The Sequence Matters Market returns in the years immediately before and after retirement significantly impact your financial security. This “sequence of returns risk” can’t be captured by simple doubling calculations.

Rebalancing Discipline: As assets grow at different rates, your allocation drifts. Annual rebalancing maintains your risk profile and can enhance returns through disciplined buy-low, sell-high behavior.

Tax Efficiency Multiplies Results. Minimizing taxes on investment returns is equivalent to boosting those returns. A 10% return that you keep is better than a 12% return that’s heavily taxed.

Avoid These Common Mistakes

- Chasing performance: Last year’s top performer is often next year’s disappointment

- Market timing: Attempting to predict short-term movements usually backfires

- Overconfidence: One successful investment doesn’t make you an expert

- Neglecting costs: A 1% fee difference can cost hundreds of thousands over a lifetime

- Emotional decisions: Fear and greed destroy long-term returns

Professional Financial Planning

While the Rule of 72 is a valuable tool, it’s just one piece of comprehensive financial planning. Consider working with a certified financial planner (CFP) who can:

- Create a holistic financial plan addressing insurance, taxes, estate planning, and investments

- Provide objective advice (fee-only planners avoid conflicts of interest)

- Help you stay disciplined during market turbulence

- Optimize tax strategies specific to your situation

- Coordinate with your accountant and attorney for comprehensive planning

I’ve created a comprehensive, professionally structured blog article on the Rule of 72 for you. This guide includes:

✅ Complete Structure: Introduction, objectives, importance, purpose, overview, 101 practical strategies, pros & cons, professional advice, conclusion, summary, and FAQs

✅ Monetization-Ready: Written in an engaging, SEO-friendly style perfect for attracting readers and affiliate marketing opportunities

✅ Actionable Content: Real strategies across stocks, real estate, retirement accounts, bonds, alternative investments, risk management, and more

✅ Professional Authority: Includes expert recommendations, realistic expectations, and guidance for different life stages

✅ Reader-Friendly: Clear formatting, practical examples, and accessible explanations of complex financial concepts

The article is designed to be both educational and evergreen, making it perfect for driving consistent traffic to your blog. You can enhance monetization by adding affiliate links to investment platforms, financial planning services, or recommended books throughout the content.

Conclusion

The Rule of 72 stands as one of finance’s most enduring and practical tools — a simple formula that unlocks profound understanding of wealth accumulation. From its elegant mathematics to its universal application, this rule transforms abstract compound interest into tangible timelines you can visualize and act upon.

Throughout this guide, we’ve explored 101 ways to leverage the Rule of 72, spanning traditional investments like stocks and bonds to alternative assets like real estate and cryptocurrencies. We’ve examined how to optimize returns through tax efficiency, risk management, and behavioral discipline. Most importantly, we’ve grounded these strategies in realistic expectations and professional wisdom.

The path to doubling your money isn’t mysterious or reserved for financial elites. It requires three fundamental elements: starting with whatever capital you have, consistently adding to it, and patiently allowing compound interest to work its magic. The Rule of 72 provides the roadmap — showing exactly how different return rates translate into wealth-doubling timelines.

As you move forward into 2025 and beyond, remember that financial success isn’t about making perfect investment choices. It’s about making good choices consistently, avoiding major mistakes, and giving your investments the most powerful ingredient of all: time. Every day you delay is a day compound interest can’t work for you. Every dollar you invest today is a dollar that begins its journey toward doubling.

Whether your goal is retirement security, a home down payment, children’s education, or financial independence, the principles underlying the Rule of 72 remain your constant companion. Use this knowledge wisely, invest with discipline, and watch as the mathematical certainty of compound interest transforms your financial future.

The best time to start was yesterday. The second-best time is right now.

Summary: Key Takeaways

- The Rule of 72 formula: Years to double = 72 ÷ Annual Return Rate

- Works best for returns between 6–10%, with reasonable accuracy from 4–15%

- Application is universal: Stocks, bonds, real estate, savings, any investment vehicle

- Time is the secret weapon: Starting early dramatically amplifies compound interest

- Realistic expectations matter: The Historical market average is approximately 10% for stocks

- Diversification reduces risk while maintaining acceptable returns

- Fees and taxes significantly impact the actual doubling time

- Regular contributions accelerate wealth building beyond simple doubling calculations

- Emotional discipline is as important as investment selection

- Professional guidance is valuable for complex situations and comprehensive planning

Frequently Asked Questions

Q1: Is the Rule of 72 accurate for all interest rates?

The Rule of 72 is most accurate for rates between 6% and 10%. For very low rates (under 5%) or very high rates (above 12%), the approximation becomes less precise. For extreme accuracy, use 69.3 instead of 72, or calculate the exact logarithmic formula. However, for practical purposes, the Rule of 72 provides perfectly adequate estimates.

Q2: Can I use the Rule of 72 for monthly compounding?

The Rule of 72 works for any compounding frequency as long as you’re using the effective annual rate. If an investment offers 6% compounded monthly, the effective annual rate is slightly higher (about 6.17%), which is what you’d use in the formula. Most investment returns are already quoted as annual figures.

Q3: How does inflation affect the Rule of 72?

Inflation works against you using the same Rule of 72. At 3% annual inflation, your purchasing power halves every 24 years (72 ÷ 3). To find your real return, subtract inflation from your nominal return. A 9% investment return with 3% inflation means your real return is 6%, and your purchasing power doubles every 12 years, not 8.

Q4: Should I aim for the highest return possible to double my money fastest?

Not necessarily. Higher returns almost always come with higher risk. An aggressive strategy promising 15% returns might sound attractive (doubling in 4.8 years), but if volatility causes you to panic and sell during a downturn, you could lose money instead. Choose returns appropriate for your risk tolerance and time horizon. A consistent 8% that you can stick with beats a volatile 12% that you abandon.

Q5: Does the Rule of 72 account for regular monthly contributions?

No, the basic Rule of 72 only calculates doubling time for a lump sum investment. Regular contributions dramatically accelerate wealth building beyond what the rule predicts. To project growth with regular contributions, you’ll need more complex calculations or financial planning tools. However, the Rule of 72 still helps you understand the underlying return rate’s impact.

Q6: What’s a realistic annual return to expect in 2025?

Historical averages suggest:

- Broad stock market (S&P 500): 9–10% long-term average

- Balanced portfolio (60/40 stocks/bonds): 7–8%

- Conservative portfolio (more bonds): 5–6%

- High-yield savings: 4–5%

Past performance doesn’t guarantee future results, but these provide reasonable planning assumptions. Consider consulting a financial advisor for personalized projections.

Q7: Is doubling my money in 5 years realistic?

Doubling in 5 years requires approximately 14.4% annual returns (72 ÷ 5 = 14.4%). While possible, this significantly exceeds historical market averages and would require either exceptional investment selection, higher risk tolerance, or getting lucky with timing. Most financial planners would consider this an aggressive and potentially unrealistic goal for the core of your portfolio.

Q8: Can I lose money even when my investment follows the Rule of 72?

The Rule of 72 assumes positive returns. If your investment loses value, you’re not doubling anything. Additionally, markets fluctuate, and temporary downturns are normal. An investment projected to double in 9 years at 8% might be down significantly in year 4 or 5 before recovering. The Rule of 72 describes the long-term average, not the year-by-year journey.

Q9: Should I use the Rule of 72 or a financial calculator?

Both have their place. The Rule of 72 is perfect for quick mental estimates, comparing options, and building intuition about compound interest. Financial calculators (or spreadsheets) are better for precise planning, especially when dealing with regular contributions, varying returns, taxes, and specific timelines. Use the Rule of 72 for ballpark figures, then dive deeper with detailed calculations for actual financial decisions.

Q10: At what age is it too late to benefit from compound interest?

It’s never too late! While starting younger provides more time for compounding, even investors in their 50s or 60s can benefit significantly. Someone aged 55 with a 10-year time horizon can still double their money at a 7.2% return. The key is adjusting your strategy to your time horizon — older investors typically reduce risk but still pursue growth appropriate to their situation.

Thank you for reading this comprehensive guide to the Rule of 72! The journey to doubling your money begins with understanding, continues with action, and succeeds through discipline. May your investments grow steadily, your financial decisions be wise, and your wealth-building journey be prosperous. Here’s to your financial success in 2025 and beyond!

No comments:

Post a Comment