101 Tips For Boosting Your Passive Income Streams In 2024

### Introduction

Passive income refers to earnings derived from activities in which an individual is not actively involved. Unlike traditional income from employment, passive income streams require initial effort but continue to generate revenue with minimal ongoing effort. Common sources include real estate investments, dividends from stocks, royalties, and online businesses.

### Importance

Creating multiple streams of passive income is crucial for financial security and independence. It can supplement your primary income, provide financial stability during economic downturns, and even replace traditional employment. By diversifying income sources, you reduce reliance on a single income stream, thus mitigating financial risks.

### Objective

The objective of this guide is to provide actionable tips to help you boost your passive income streams in 2024. By implementing these strategies, you can enhance your financial portfolio, achieve greater financial independence, and secure a steady flow of income with minimal active involvement.

### Overview

Passive income can be categorized into several key areas:

1. **Real Estate**: Investing in properties for rental income, participating in real estate crowdfunding, and buying REITs.

2. **Stock Market**: Investing in dividend stocks, index funds, and ETFs.

3. **Bonds and CDs**: Using municipal, corporate, and government bonds, as well as high-yield savings accounts.

4. **Online Business**: Engaging in affiliate marketing, blogging, and selling digital products.

5. **Peer-to-Peer Lending**: Providing loans to individuals or businesses through online platforms.

6. **Royalties**: Earning from intellectual property such as music, books, and patents.

7. **Technology and Apps**: Developing software, mobile apps, and browser extensions.

8. **Alternative Investments**: Exploring options like cryptocurrency staking and art investments.

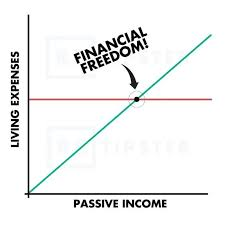

### Psychology of Passive Income

Understanding the psychology behind passive income is essential. The mindset shift from earning active income to building passive income involves long-term thinking and patience. It requires a willingness to invest time and money upfront for future rewards. The sense of financial freedom and security that comes from passive income can also positively impact mental well-being, reducing stress and providing a sense of control over one's financial future.

### Pros

1. **Financial Freedom**: Achieve financial independence by diversifying income streams.

2. **Reduced Risk**: Mitigate financial risks by not relying on a single income source.

3. **Time Flexibility**: Generate income with minimal ongoing effort, allowing more time for personal pursuits.

4. **Scalability**: Many passive income strategies can be scaled to increase earnings.

5. **Residual Earnings**: Earn continuously from initial efforts, such as writing a book or creating an online course.

### Cons

1. **Initial Investment**: Most passive income streams require a significant initial investment of time, money, or both.

2. **Risk of Loss**: Investments, particularly in the stock market or real estate, carry the risk of loss.

3. **Maintenance**: Some passive income sources, like rental properties, require ongoing maintenance and management.

4. **Learning Curve**: There is often a steep learning curve to understand and effectively implement passive income strategies.

5. **Unpredictability**: Some passive income sources, such as online businesses or investments, can be unpredictable and fluctuate over time.

101 tips for boosting your passive income streams in 2024:---

### Real Estate

1. **Invest in Rental Properties:** Purchase properties to rent out for a steady income.

2. **Real Estate Crowdfunding:** Participate in crowdfunding platforms to invest in real estate.

3. **REITs (Real Estate Investment Trusts):** Invest in REITs for dividends.

4. **Short-Term Rentals:** Use platforms like Airbnb to rent out properties.

5. **House Hacking:** Rent out parts of your primary residence.

6. **Vacation Rentals:** Invest in properties in tourist destinations.

7. **Commercial Real Estate:** Invest in office buildings or retail spaces.

8. **Real Estate Syndications:** Pool money with other investors to buy large properties.

9. **Farmland Investments:** Purchase farmland for leasing.

10. **Real Estate Notes:** Invest in real estate-backed loans.

### Stock Market

11. **Dividend Stocks:** Invest in stocks that pay regular dividends.

12. **Index Funds:** Invest in low-cost index funds for long-term growth.

13. **ETFs (Exchange-Traded Funds):** Diversify with ETFs.

14. **DRIPs (Dividend Reinvestment Plans):** Reinvest dividends to compound growth.

15. **Preferred Stocks:** Invest in preferred shares for higher dividends.

### Bonds and CDs

16. **Municipal Bonds:** Invest in tax-free municipal bonds.

17. **Corporate Bonds:** Purchase bonds from stable companies.

18. **Government Bonds:** Invest in Treasury bonds.

19. **High-Yield Savings Accounts:** Open a high-yield savings account.

20. **Certificates of Deposit (CDs):** Invest in CDs for fixed returns.

### Online Business

21. **Affiliate Marketing:** Earn commissions by promoting products.

22. **Blogging:** Monetize a blog through ads and sponsored posts.

23. **YouTube Channel:** Create videos and earn from ads.

24. **Online Courses:** Sell educational courses on platforms like Udemy.

25. **Ebooks:** Write and sell ebooks.

26. **Print on Demand:** Design and sell custom products.

27. **Dropshipping:** Start an online store without holding inventory.

28. **Niche Websites:** Build websites targeting specific audiences and monetize them.

29. **Podcasting:** Monetize a podcast through sponsorships and ads.

30. **Membership Sites:** Charge for exclusive content.

### Peer-to-Peer Lending

31. **P2P Lending Platforms:** Lend money to individuals and earn interest.

32. **Business Loans:** Provide loans to small businesses.

33. **Microloans:** Offer small loans to entrepreneurs in developing countries.

### Royalties

34. **Music Royalties:** Invest in music rights and earn royalties.

35. **Book Royalties:** Write books and earn from sales.

36. **Patent Royalties:** License patents for ongoing income.

37. **Trademark Licensing:** License trademarks for a fee.

### Apps and Software

38. **Mobile Apps:** Develop and sell mobile apps.

39. **Software as a Service (SaaS):** Create a subscription-based software service.

40. **Browser Extensions:** Develop extensions for browsers and monetize them.

### Financial Instruments

41. **Options Trading:** Trade options for passive income.

42. **Covered Calls:** Sell covered call options on stocks you own.

43. **Annuities:** Invest in annuities for regular payouts.

44. **Peer-to-Peer Insurance:** Invest in P2P insurance platforms.

### Automate Your Income

45. **Robo-Advisors:** Use robo-advisors to manage investments.

46. **Automatic Savings Plans:** Set up automatic transfers to savings/investment accounts.

47. **Dividend Reinvestment Plans (DRIPs):** Automate dividend reinvestments.

### Side Hustles with Passive Potential

48. **Vending Machines:** Invest in vending machines.

49. **ATM Machines:** Own and operate ATMs.

50. **Laundromats:** Invest in laundromats for steady cash flow.

### Intellectual Property

51. **Create Online Courses:** Build and sell courses on platforms like Coursera.

52. **Design Templates:** Create and sell templates for websites, resumes, etc.

53. **Stock Photography:** Sell photos on stock photography sites.

54. **Video Clips:** Sell stock video footage.

### Rent Out Assets

55. **Car Rentals:** Rent out your car.

56. **Storage Space:** Rent out unused storage space.

57. **Equipment Rentals:** Rent out tools or equipment.

58. **Parking Spaces:** Rent out parking spots.

### Social Media

59. **Influencer Marketing:** Partner with brands to promote products.

60. **Sponsored Content:** Create sponsored posts for brands.

### Energy and Utilities

61. **Solar Panels:** Invest in solar panels and sell excess energy.

62. **Wind Turbines:** Invest in small-scale wind turbines.

### Cryptocurrency

63. **Staking:** Stake cryptocurrencies for rewards.

64. **Yield Farming:** Provide liquidity to earn interest.

65. **Masternodes:** Invest in masternodes for passive income.

### Real Estate Alternative Investments

66. **Tax Lien Certificates:** Invest in tax lien certificates.

67. **Mobile Home Parks:** Invest in mobile home parks.

### Niche Investments

68. **Wine Investing:** Invest in fine wines.

69. **Art Investments:** Invest in artworks.

70. **Collectibles:** Invest in rare collectibles (stamps, coins, etc.).

### Education and Tutoring

71. **Create Educational Games:** Develop and sell educational games.

72. **Tutoring Platforms:** Build a tutoring platform and charge a fee.

### Subscriptions

73. **Subscription Boxes:** Start a subscription box service.

74. **Membership Fees:** Charge for membership in a club or service.

### Technology

75. **Develop Software:** Create and sell software applications.

76. **Tech Startups:** Invest in tech startups for equity.

### Business Investments

77. **Franchise Ownership:** Own and operate a franchise.

78. **Silent Partnership:** Invest as a silent partner in a business.

### Content Creation

79. **Write for Revenue-Sharing Sites:** Contribute to sites that share ad revenue.

80. **Create an Online Magazine:** Start a digital magazine and sell subscriptions.

### Real Estate Specialties

81. **Vacation Property Management:** Manage vacation rentals for others.

82. **Real Estate Photography:** Sell photography services to real estate agents.

### Financial Products

83. **High-Yield Bonds:** Invest in high-yield corporate bonds.

84. **Peer-to-Peer Investments:** Invest in P2P financial products.

### Lifestyle

85. **Car Advertising:** Earn by placing ads on your car.

86. **Social Media Management:** Manage social media accounts for businesses.

### Agriculture

87. **Tree Farming:** Invest in tree farming.

88. **Aquaculture:** Invest in fish farming.

### Passive Income from Employment

89. **Employee Stock Purchase Plans:** Participate in ESPPs.

90. **Deferred Compensation Plans:** Use deferred compensation for future income.

### Tech Devices

91. **Smart Vending Machines:** Invest in IoT-enabled vending machines.

92. **3D Printing Services:** Provide 3D printing services.

### Financial Planning

93. **Life Insurance Dividends:** Invest in dividend-paying life insurance policies.

94. **Health Savings Accounts (HSAs):** Contribute to HSAs for tax-free growth.

### Miscellaneous

95. **Royalty Investments:** Invest in royalties from different sources.

96. **Internet of Things (IoT) Devices:** Invest in IoT devices for recurring revenue.

97. **Financial Blog:** Start a financial blog and earn through affiliate marketing.

98. **Web Hosting Services:** Offer web hosting services.

99. **Virtual Real Estate:** Buy and sell domain names.

100. **Online Marketplaces:** Create and run an online marketplace.

101. **Sell Digital Products:** Create and sell digital products like fonts, plugins, or graphics.

### Summary

Creating and boosting passive income streams is a strategic approach to achieving financial stability and independence. This guide has provided 101 tips across various categories, including real estate, the stock market, bonds, online businesses, and more. By diversifying your income sources, you can reduce financial risk and enjoy greater flexibility and freedom.

### Conclusion

Building passive income streams is a valuable endeavor for anyone seeking financial security and independence. While the initial investment of time and resources can be substantial, the long-term benefits of reduced financial risk, increased earnings, and greater personal freedom are well worth the effort. By leveraging the tips and strategies outlined in this guide, you can take concrete steps toward enhancing your passive income in 2024 and beyond. Implementing these tips can diversify your income sources and enhance your financial stability. Choose strategies that align with your interests and expertise for the best results.

Thank You Very Much With Warm Gratitude