101 Ways to Emerging Opportunities in the Fintech Space in 2024

### Introduction

In the dynamic landscape of 2024, fintech stands as a beacon of innovation, reshaping how we perceive and interact with financial services. This introduction delves into the transformative power of fintech, exploring avenues for generating passive income, achieving financial freedom, and leveraging digital marketing to amplify these opportunities.

### Fintech Revolution

Fintech, short for financial technology, encompasses a spectrum of innovations that streamline financial processes, enhance accessibility, and democratize investment opportunities. From blockchain and cryptocurrencies to AI-driven robo-advisors and mobile banking solutions, fintech is at the forefront of revolutionizing the financial industry.

### Making Money and Passive Income

The fintech boom offers numerous avenues to generate income and build wealth passively. Whether through investing in cryptocurrencies, participating in decentralized finance (DeFi), or utilizing AI-powered trading platforms, individuals can capitalize on emerging trends to grow their financial portfolios.

### Achieving Financial Freedom

Financial freedom is a cornerstone goal facilitated by fintech innovations. By embracing automated savings apps, personalized investment strategies, and digital wealth management platforms, individuals can take control of their financial destiny and achieve long-term stability.

### Digital Marketing in Fintech

Digital marketing plays a pivotal role in promoting fintech solutions and reaching a global audience. Through targeted social media campaigns, content marketing, and SEO strategies, fintech companies can educate consumers, build trust, and foster adoption of their services.

### Importance and Objectives

The importance of fintech lies in its ability to democratize financial services, improve efficiency, and foster innovation. The primary objectives include enhancing financial inclusion, optimizing user experiences, and driving economic growth through technological advancements.

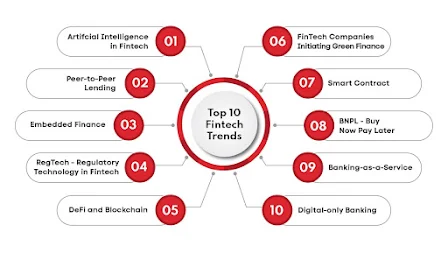

### Overviews of Fintech Innovations

This section provides an overview of key fintech innovations in 2024, including AI-driven solutions, blockchain applications, digital banking advancements, and the integration of sustainable finance principles. Each innovation contributes to reshaping the financial landscape and creating new opportunities for businesses and consumers alike.

### Psychology of Fintech Adoption

Understanding the psychology behind fintech adoption is crucial. Factors such as trust, convenience, and perceived value influence consumer behavior and adoption rates. Fintech companies must navigate these psychological aspects to successfully onboard users and drive engagement.

### Pros and Cons of Fintech

#### Pros

- **Efficiency**: Streamlines financial processes and reduces costs.

- **Accessibility**: Democratizes access to financial services globally.

- **Innovation**: Drives continuous improvements and new opportunities.

- **Convenience**: Enhances user experience with seamless digital solutions.

#### Cons

- **Security Risks**: Increased vulnerability to cyber threats and data breaches.

- **Regulatory Challenges**: Navigating complex regulatory landscapes across jurisdictions.

- **Privacy Concerns**: Safeguarding sensitive user information and maintaining trust.

- **Technological Barriers**: Bridging the digital divide and ensuring inclusive access.

The fintech industry continues to grow and evolve, presenting a plethora of opportunities for innovation, investment, and growth. Here are 101 ways to capitalize on emerging opportunities in the fintech space in 2024:

#### 1. Digital Banking

Launch digital-only banks offering seamless, user-friendly experiences.

#### 2. Blockchain Solutions

Develop blockchain-based applications for secure, transparent transactions.

#### 3. Cryptocurrency Investments

Invest in and trade cryptocurrencies like Bitcoin and Ethereum.

#### 4. Central Bank Digital Currencies (CBDCs)

Engage in the development and deployment of CBDCs.

#### 5. Decentralized Finance (DeFi)

Create or invest in DeFi platforms for peer-to-peer financial services.

#### 6. AI-Powered Trading

Utilize AI algorithms for automated trading and investment strategies.

#### 7. Machine Learning for Credit Scoring

Develop ML models for more accurate and fair credit scoring.

#### 8. Big Data Analytics

Leverage big data for insights in risk management and customer behavior.

#### 9. Regtech Solutions

Create technologies to streamline regulatory compliance and reporting.

#### 10. Enhanced Cybersecurity

Innovate in cybersecurity to protect financial data and transactions.

#### 11. Open Banking

Implement open banking frameworks to allow third-party financial services.

#### 12. Peer-to-Peer (P2P) Lending

Develop P2P lending platforms to connect borrowers directly with lenders.

#### 13. Mobile Payment Systems

Design mobile payment solutions for easy, on-the-go transactions.

#### 14. Biometric Authentication

Introduce biometric solutions for secure financial authentication.

#### 15. Quantum Computing in Finance

Explore quantum computing for complex financial calculations.

#### 16. Smart Contracts

Develop and deploy smart contracts for automated, secure agreements.

#### 17. Internet of Things (IoT) in Finance

Utilize IoT for real-time data collection and financial insights.

#### 18. Crowdfunding Platforms

Create crowdfunding platforms to support startups and projects.

#### 19. Insurtech Innovations

Develop insurtech solutions to modernize the insurance industry.

#### 20. Robo-Advisors

Launch robo-advisory services for automated financial planning.

#### 21. Personal Finance Management Apps

Create apps to help users budget, save, and manage their finances.

#### 22. Embedded Finance

Integrate financial services into non-financial company offerings.

#### 23. Digital Identity Verification

Develop digital ID verification systems for secure onboarding.

#### 24. Social Trading Platforms

Create platforms where users can follow and mimic successful traders.

#### 25. Wealthtech Solutions

Innovate in wealth management with advanced tech tools.

#### 26. Neobanks

Launch neobanks that offer digital-first banking experiences.

#### 27. Financial Inclusion

Develop fintech solutions for unbanked and underbanked populations.

#### 28. Tokenization of Assets

Tokenize real-world assets for increased liquidity and accessibility.

#### 29. Sustainable Finance Platforms

Support green investments and sustainable finance initiatives.

#### 30. Automated Customer Service

Implement chatbots and virtual assistants for 24/7 customer support.

#### 31. Payment Gateways

Create secure payment gateways for e-commerce transactions.

#### 32. Digital Wallets

Develop digital wallets for storing and managing payment information.

#### 33. Cross-Border Payments

Innovate to make international payments faster and cheaper.

#### 34. API Integrations

Facilitate seamless integration of fintech services with APIs.

#### 35. Data Privacy Solutions

Ensure compliance with data privacy regulations through advanced solutions.

#### 36. Real-Time Payments

Develop systems for instantaneous payment processing.

#### 37. Digital Tax Solutions

Create platforms for simplified tax filing and compliance.

#### 38. Financial Literacy Platforms

Educate consumers with platforms focused on financial literacy.

#### 39. Predictive Analytics

Use predictive analytics for forecasting market trends and behaviors.

#### 40. Micro-Investing Platforms

Launch apps that allow small-scale investments by users.

#### 41. Virtual Currencies

Explore virtual currencies for efficient transactions in digital ecosystems.

#### 42. Transparent Fee Structures

Offer clear and straightforward fee structures to build trust.

#### 43. AI-Driven Credit Scoring

Develop AI models to improve the accuracy of credit scoring.

#### 44. Secure Cloud Computing

Enhance security and scalability with cloud-based financial services.

#### 45. AI-Powered Risk Management

Use AI tools to identify and mitigate financial risks.

#### 46. Sustainable Investing Platforms

Create platforms focused on investments in ESG-compliant companies.

#### 47. Digital-Only Insurance

Streamline the insurance process with digital-first solutions.

#### 48. E-KYC (Electronic Know Your Customer)

Implement E-KYC to simplify and secure customer onboarding.

#### 49. Algorithmic Trading

Develop systems for executing trades using advanced algorithms.

#### 50. Financial Super Apps

Build super apps that offer a wide range of financial services.

#### 51. Tokenized Securities

Increase accessibility to securities through tokenization.

#### 52. Financial Automation

Automate financial operations to reduce manual processes.

#### 53. Digital Escrow Services

Create digital escrow solutions for secure transactions.

#### 54. Contactless Payments

Innovate in contactless payment technologies for convenience.

#### 55. Real Estate Fintech

Develop fintech solutions for the real estate market.

#### 56. Digital Remittances

Offer faster and cheaper remittance services for international transfers.

#### 57. AI-Powered Personal Finance

Leverage AI for managing personal finances more effectively.

#### 58. Predictive Maintenance

Implement predictive maintenance to reduce downtime in operations.

#### 59. Identity Theft Protection

Innovate to protect users from identity theft and fraud.

#### 60. Personalized Financial Products

Create customized financial products based on user data.

#### 61. Collaborative Finance Platforms

Facilitate collaboration between traditional financial institutions and fintech firms.

#### 62. Digital Banking for SMEs

Provide digital banking solutions tailored to small and medium-sized enterprises.

#### 63. Multi-Currency Accounts

Develop accounts that support multiple currencies for international transactions.

#### 64. Ethical Fintech

Focus on creating fintech solutions with social and ethical considerations.

#### 65. Automated Fraud Detection

Use AI to detect and prevent fraudulent activities in real time.

#### 66. Cross-Platform Integration

Ensure fintech services are accessible across various platforms and devices.

#### 67. Digital Financial Advisors

Offer digital financial advisory services for tailored advice.

#### 68. Mobile-First Financial Services

Design financial services with a mobile-first approach for better user experience.

#### 69. Virtual Reality in Finance

Utilize VR for immersive financial education and planning experiences.

#### 70. AI-Enhanced Underwriting

Improve underwriting processes with AI for better accuracy and efficiency.

#### 71. Social Impact Investing

Create platforms that connect investors with socially impactful projects.

#### 72. Digital Financial Inclusion

Develop solutions that bring financial services to marginalized communities.

#### 73. Open Finance

Extend open banking principles to a broader range of financial data.

#### 74. Augmented Reality in Finance

Enhance user experiences with AR applications in financial services.

#### 75. Automated Tax Solutions

Simplify tax preparation and filing with automated tools.

#### 76. Fintech Incubators and Accelerators

Support fintech startups through mentorship and funding programs.

#### 77. Sustainable Finance Reporting

Create tools for reporting on the environmental and social impact of financial activities.

#### 78. AI-Powered Investment Platforms

Use AI to provide insights and recommendations for investment decisions.

#### 79. Fintech Ecosystems

Foster collaborative ecosystems for innovation in fintech.

#### 80. Hyper-Personalization

Deliver hyper-personalized financial services to meet individual needs.

#### 81. Digital Currencies for Microtransactions

Facilitate efficient microtransactions with digital currencies.

#### 82. ESG Investing

Focus on Environmental, Social, and Governance (ESG) criteria for investments.

#### 83. Fintech for the Aging Population

Develop solutions addressing the financial needs of the aging population.

#### 84. AI-Driven Market Analysis

Use AI tools to analyze market trends and provide actionable insights.

#### 85. Automated Portfolio Management

Automate investment portfolio management based on predefined criteria.

#### 86. Real-Time Financial Data

Enhance decision-making with real-time data analytics.

#### 87. Digital Invoicing

Streamline billing and payment processes with digital invoicing solutions.

#### 88. AI Chatbots

Implement AI chatbots for instant customer support and engagement.

#### 89. Fintech for Gig Economy

Provide financial solutions tailored to gig workers and freelancers.

#### 90. Crowdsourced Investment Platforms

Enable collective investments through crowdsourcing platforms.

#### 91. Digital Asset Management

Manage digital assets, including cryptocurrencies and NFTs, with innovative tools.

#### 92. AI-Driven Financial Forecasting

Predict future financial trends with AI-driven models.

#### 93. Biometric Payments

Enhance payment security with biometric authentication.

#### 94. Sustainable Savings Accounts

Offer savings accounts that support environmentally friendly initiatives.

#### 95. Personalized Credit Products

Develop credit products tailored to individual financial situations.

#### 96. Mobile Banking for Rural Areas

Provide banking services to underserved rural populations with mobile solutions.

#### 97. Digital Financial Health Platforms

Assess and improve users' financial health with digital platforms.

#### 98. Instant Loan Approval

Streamline loan approval processes with AI and ML for faster decisions.

#### 99. Cloud-Based Financial Services

Enhance scalability and security with cloud-based financial services.

#### 100. Blockchain for Supply Chain Finance

Improve transparency and efficiency in supply chain finance with blockchain.

#### 101. Fintech Partnerships

Drive innovation and growth through collaborations between fintech companies and traditional financial institutions.

In 2024, the fintech space is rich with opportunities for innovation and growth. By exploring these emerging trends and technologies, businesses

and individuals can stay ahead in the rapidly evolving financial landscape.

### Summary

In summary, fintech in 2024 represents a transformative force in the global economy, offering unprecedented opportunities for individuals and businesses to thrive financially. Through innovative technologies, strategic investments, and robust digital marketing strategies, stakeholders can harness the power of fintech to achieve their financial goals and aspirations.

### Conclusion

The future of fintech is bright and promising, marked by continuous innovation, increased accessibility, and broader financial inclusion. By embracing fintech solutions, individuals can embark on a journey towards financial freedom, leveraging passive income streams and digital marketing tactics to amplify their financial success.

**Thank you very much with warm gratitude.**

This comprehensive exploration of fintech, passive income, digital marketing, and the pursuit of financial freedom aims to inspire and empower individuals to navigate and capitalize on the evolving fintech landscape of 2024.