101 Benefits Of Passive Income in 2024

### Introduction

In the modern financial landscape of 2024, passive income has become an increasingly popular and viable strategy for achieving financial stability and independence. Passive income refers to earnings derived from activities in which the individual is not actively involved regularly. This can include income from investments, rental properties, royalties, and online businesses, among others. The appeal of passive income lies in its potential to generate continuous revenue streams with minimal ongoing effort, allowing individuals to focus on other life pursuits while maintaining financial security.

### Importance

The importance of passive income in 2024 cannot be overstated. As the world faces economic uncertainties, inflation, and job market fluctuations, having multiple sources of income provides a financial safety net that mitigates risks associated with sole reliance on traditional employment. Passive income streams contribute to financial freedom, enabling individuals to achieve a better work-life balance, reduce stress, and attain their financial goals more swiftly. This financial stability allows for more strategic investments, early retirement, and the ability to pursue personal passions without the constant pressure of earning an active income.

Moreover, passive income fosters entrepreneurial freedom and encourages innovation by allowing individuals to explore new business ventures without the fear of financial instability. It also supports the creation of generational wealth, offering a means to secure a better future for one's family. The diverse benefits of passive income, ranging from improved mental health to enhanced quality of life, make it an essential component of a modern financial strategy.

101 Benefits Of Passive Income in 2024

Creating passive income streams can offer numerous benefits, especially in 2024, given the evolving economic landscape, technological advancements, and changing work dynamics. Here are 101 benefits of passive income:

1. **Financial Freedom**: Achieve independence from traditional 9-to-5 jobs.

2. **Work-Life Balance**: More time with family and friends.

3. **Diverse Income Streams**: Multiple income sources reduce financial risk.

4. **Retirement Savings**: Supplement or replace retirement savings.

5. **Debt Reduction**: Extra income to pay off debts faster.

6. **Reduced Stress**: Less financial anxiety with more income security.

7. **Flexible Lifestyle**: Ability to travel or live anywhere.

8. **Increased Savings**: More money to save for future goals.

9. **Investment Opportunities**: Extra funds for investing in stocks, real estate, etc.

10. **Entrepreneurial Freedom**: Ability to explore new business ventures.

11. **Early Retirement**: Potential to retire earlier than planned.

12. **Financial Cushion**: Extra funds for emergencies.

13. **Generational Wealth**: Build wealth to pass to future generations.

14. **Philanthropy**: More ability to donate to charities and causes.

15. **Personal Growth**: Opportunity to learn and develop new skills.

16. **Tax Benefits**: Potential tax advantages from various passive income sources.

17. **Economic Security**: Greater financial stability during economic downturns.

18. **Better Mental Health**: Reduced financial worries improve mental health.

19. **Job Security**: Less reliance on a single job for income.

20. **Scalability**: Potential to scale income with minimal extra effort.

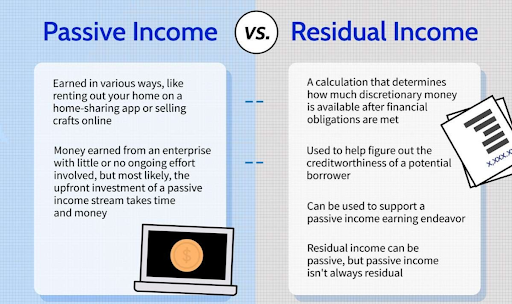

21. **Residual Income**: Continues to earn without active involvement.

22. **Creativity**: Freedom to pursue creative passions without financial pressure.

23. **Diversification**: Spreading income sources reduces overall risk.

24. **Financial Goals**: Faster achievement of financial milestones.

25. **Location Independence**: Ability to earn money anywhere globally.

26. **Time for Hobbies**: More free time to pursue hobbies and interests.

27. **Quality of Life**: Overall improvement in living standards.

28. **Health Benefits**: Reduced stress leads to better physical health.

29. **Investment Knowledge**: Gain valuable investment knowledge and experience.

30. **Less Burnout**: Avoid burnout from traditional work environments.

31. **Skill Diversification**: Opportunity to develop diverse skill sets.

32. **Networking**: Meet like-minded individuals and expand professional networks.

33. **Legacy Building**: Create a lasting impact through sustainable income streams.

34. **Cushion Against Inflation**: Passive income can help counteract inflation.

35. **Market Flexibility**: Adaptability to changing market conditions.

36. **Capital Growth**: Potential for significant capital appreciation.

37. **Enhanced Credit Score**: Better income can improve creditworthiness.

38. **Freedom from Office Politics**: Avoid traditional workplace dynamics.

39. **Family Time**: More quality time with loved ones.

40. **Passive Learning**: Learn about new industries and markets.

41. **Lifestyle Upgrades**: Afford luxury items and experiences.

42. **Peace of Mind**: Financial security provides peace of mind.

43. **Digital Nomad Lifestyle**: Embrace a location-independent lifestyle.

44. **Home Ownership**: More funds available for buying a home.

45. **Travel Opportunities**: Freedom and funds to travel more frequently.

46. **Life Purpose**: Time to pursue meaningful and fulfilling activities.

47. **Continuous Income**: Ongoing revenue streams without active work.

48. **Reduced Work Hours**: Potential to work fewer hours overall.

49. **Reduced Commuting**: Less or no daily commute.

50. **Financial Independence**: Less reliance on traditional employment.

51. **Peaceful Retirement**: A more comfortable and secure retirement.

52. **Home Renovations**: Funds for improving living conditions.

53. **Educational Pursuits**: Ability to afford further education.

54. **Child’s Education**: More funds for children’s education.

55. **Real Estate Ownership**: Ability to invest in real estate properties.

56. **High Return Potential**: Some passive income sources offer high returns.

57. **Low Effort Maintenance**: Many passive incomes require minimal ongoing effort.

58. **Multiple Ventures**: Ability to handle multiple ventures simultaneously.

59. **Freedom from Financial Constraints**: Less worry about day-to-day expenses.

60. **Early Payoff of Mortgages**: Pay off home loans faster.

61. **Pursue Passions**: Financial freedom to follow your passions.

62. **Digital Investments**: Invest in cryptocurrencies and digital assets.

63. **Rental Income**: Steady income from rental properties.

64. **Stock Dividends**: Earnings from investments in stocks.

65. **Online Businesses**: Revenue from e-commerce and online ventures.

66. **Content Creation**: Earnings from blogs, YouTube, and other platforms.

67. **Affiliate Marketing**: Commissions from promoting products.

68. **Royalty Income**: Earnings from books, music, and patents.

69. **P2P Lending**: Interest from peer-to-peer lending.

70. **Savings on Childcare**: Less need for paid childcare services.

71. **E-commerce Profits**: Revenue from online stores.

72. **Subscription Services**: Income from subscription-based models.

73. **Freelance Opportunities**: Ability to take on freelance projects.

74. **Mobile Income**: Earnings from mobile apps and games.

75. **Crowdfunding**: Profits from participating in crowdfunding ventures.

76. **Licensing Deals**: Income from licensing intellectual property.

77. **Gig Economy**: Earnings from gig work on platforms like Uber or Airbnb.

78. **Automated Businesses**: Revenue from automated business models.

79. **Investment Income**: Interest from various investments.

80. **Stock Market**: Gains from stock market investments.

81. **Dividend Reinvestment**: Compounding returns through reinvested dividends.

82. **REITs**: Income from Real Estate Investment Trusts.

83. **Bond Interest**: Earnings from bond investments.

84. **Annuities**: Regular payments from annuities.

85. **Insurance Policies**: Cash value from certain life insurance policies.

86. **Royalties from Digital Products**: Income from digital product sales.

87. **Franchise Ownership**: Earnings from franchise businesses.

88. **Partnerships**: Income from business partnerships.

89. **Fixed Deposits**: Interest from fixed deposits.

90. **Municipal Bonds**: Tax-free income from municipal bonds.

91. **Cashback Rewards**: Earnings from cashback programs.

92. **Tax Lien Certificates**: Profits from tax lien certificates.

93. **Rental Arbitrage**: Income from subleasing properties.

94. **Dropshipping**: Profits from dropshipping businesses.

95. **Forex Trading**: Earnings from foreign exchange trading.

96. **Online Courses**: Revenue from selling online courses.

97. **Merchandising**: Income from merchandise sales.

98. **Mobile Homes**: Earnings from mobile home park investments.

99. **Cryptocurrency Staking**: Rewards from staking cryptocurrencies.

100. **Social Media Influence**: Income from social media endorsements.

101. **Domain Investments**: Profits from buying and selling domain names.

These benefits illustrate the diverse and multifaceted advantages of creating and maintaining passive income streams, making it a valuable financial strategy for the present and future.

### Pros and Cons of Passive Income

### Pros

1. **Financial Freedom**: Provides independence from traditional employment, allowing for greater financial security.

2. **Work-Life Balance**: More time to spend with family, and friends, and pursue personal interests.

3. **Multiple Income Streams**: Diversifying income sources reduces financial risk.

4. **Debt Reduction**: Extra income can help pay off debts faster.

5. **Reduced Stress**: Financial security leads to less anxiety and better mental health.

6. **Flexible Lifestyle**: Ability to travel or live anywhere without being tied to a specific location.

7. **Early Retirement**: Potential to retire earlier than planned with sufficient passive income.

8. **Generational Wealth**: Build and pass down wealth to future generations.

9. **Investment Opportunities**: Extra funds for investing in various markets and opportunities.

10. **Scalability**: Potential to increase income with minimal additional effort once the systems are in place.

11. **Residual Income**: Continues to earn without active involvement after the initial setup.

12. **Tax Benefits**: Some passive income sources offer tax advantages.

13. **Less Burnout**: Reduced reliance on traditional work environments helps avoid burnout.

14. **Financial Cushion**: Provides extra funds for emergencies and unexpected expenses.

15. **Increased Savings**: More opportunities to save for future goals and large purchases.

16. **Philanthropy**: Greater ability to donate to charities and support causes.

17. **Investment Knowledge**: Opportunity to learn and gain experience in different investment areas.

18. **Digital Nomad Lifestyle**: Freedom to work from anywhere, enabling a location-independent lifestyle.

19. **Home Ownership**: More funds available for buying and improving a home.

20. **Educational Pursuits**: Ability to afford further education and professional development.

### Cons

1. **Initial Time Investment**: Setting up passive income streams often requires a significant initial time commitment.

2. **Initial Financial Investment**: Many passive income opportunities require upfront financial investment.

3. **Maintenance Effort**: Some passive income streams still require ongoing maintenance and management.

4. **Market Risks**: Investments in stocks, real estate, and other markets come with risks that can lead to losses.

5. **Unpredictable Income**: Passive income can be inconsistent and fluctuate over time.

6. **Regulatory Risks**: Changes in laws and regulations can impact certain passive income sources.

7. **Scams and Fraud**: The risk of falling victim to scams or fraudulent investment schemes.

8. **Learning Curve**: Understanding and effectively managing passive income streams often requires substantial learning and skill development.

9. **Upfront Costs**: Initial costs for setting up passive income streams, such as purchasing property or starting an online business, can be high.

10. **Economic Dependence**: Some passive income sources are heavily dependent on the broader economic environment.

11. **Property Management**: Rental income requires dealing with tenants, property maintenance, and potential legal issues.

12. **Market Saturation**: Increased competition in popular passive income avenues can reduce profitability.

13. **Technological Dependence**: Online businesses and digital investments rely on technology, which can be prone to disruptions.

14. **Slow Returns**: It can take a long time to see significant returns from some passive income investments.

15. **Opportunity Cost**: The time and money spent setting up passive income streams could be used elsewhere.

16. **Economic Downturns**: Passive income streams can be adversely affected by economic recessions.

17. **Inflation Impact**: Inflation can erode the value of passive income over time.

18. **Asset Management**: Requires effective management and oversight of assets to ensure continued income.

19. **Skill Requirements**: Some passive income streams require specific skills and knowledge to be successful.

20. **Legal and Tax Complications**: Managing the legal and tax implications of passive income sources can be complex.

By weighing these pros and cons, individuals can make informed decisions about pursuing and managing passive income streams in a way that aligns with their financial goals and lifestyle.

### Conclusion

In conclusion, the pursuit of passive income is a powerful approach to achieving financial independence and enhancing overall quality of life. The benefits are manifold, including financial security, reduced stress, and the freedom to pursue personal and professional goals. As we navigate through 2024, the importance of passive income becomes even more pronounced, providing a buffer against economic uncertainties and enabling individuals to lead more balanced, fulfilling lives. By strategically developing and maintaining passive income streams, individuals can secure their financial future and enjoy the peace of mind that comes with financial stability.

Thank you