101 Ways of Financial Success Attitudes in Every Sphere of Life 2024

### Introduction

Financial success is a goal that many aspire to achieve, as it significantly impacts our quality of life, providing stability, opportunities, and peace of mind. The path to financial success involves adopting a set of attitudes and practices that influence our financial decisions across all areas of life.

### Importance

Achieving financial success is crucial for several reasons:

1. **Security**: It provides a safety net for emergencies and unexpected expenses.

2. **Opportunities**: It allows for investments in education, business, and other areas that can enhance life.

3. **Freedom**: Financial stability provides the freedom to make choices that align with personal goals and values.

4. **Peace of Mind**: It reduces stress related to financial uncertainties.

### Objective

The objective of this guide is to present 101 ways to cultivate financial success through various attitudes and practices. This includes understanding the psychology behind financial decisions, recognizing the benefits and drawbacks of different strategies, and applying practical advice to everyday life.

### Overviews

1. **Mindset and Attitudes**: Developing a positive and disciplined mindset towards money.

2. **Budgeting and Saving**: Effective techniques for managing money and saving for the future.

3. **Investing**: Strategies for building wealth through investments.

4. **Debt Management**: Methods to reduce and manage debt efficiently.

5. **Earning More**: Ways to increase income through career development and side hustles.

6. **Retirement Planning**: Preparing financially for retirement.

7. **Family and Lifestyle**: Incorporating financial practices into family life.

8. **Financial Tools and Technology**: Utilizing modern tools to manage finances.

9. **Long-term Strategies**: Planning for sustained financial health.

10. **Health and Wellness**: Maintaining health to avoid financial strain.

11. **Community and Giving**: The role of community involvement and philanthropy in financial success.

### Psychology

Understanding the psychology behind financial decisions is essential. Human behavior, influenced by emotions and cognitive biases, often drives financial choices. Recognizing these psychological factors can help in making more rational and beneficial financial decisions. Key psychological aspects include:

- **Delayed Gratification**: The ability to delay immediate rewards for greater future benefits.

- **Impulse Control**: Resisting the urge to make unplanned purchases.

- **Financial Literacy**: The knowledge and skills needed to make informed financial decisions.

- **Behavioral Economics**: Understanding how psychological factors influence economic decisions.

### Pros

- **Improved Financial Stability**: Better management of money leads to increased security.

- **Growth Opportunities**: Smart investments and savings can lead to significant wealth growth.

- **Reduced Stress**: Financial planning alleviates money worries.

- **Enhanced Quality of Life**: Financial success opens up opportunities for better living conditions and experiences.

### Cons

- **Time and Effort**: Achieving financial success requires consistent effort and time.

- **Risk**: Investments and financial decisions come with inherent risks.

- **Discipline Required**: Maintaining financial discipline can be challenging.

- **External Factors**: Economic downturns and unexpected events can impact financial plans.

Certainly! Achieving financial success involves a blend of practical strategies, sound decision-making, and positive attitudes. Here are 101 tips across various spheres of life that can contribute to financial success in 2024:

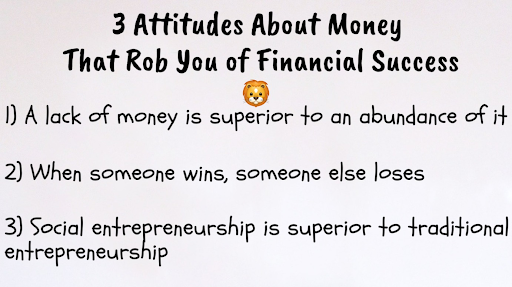

### Mindset and Attitudes

1. **Set Clear Goals**: Define what financial success means to you.

2. **Stay Positive**: Maintain a positive attitude toward money.

3. **Be Disciplined**: Consistently follow your financial plans.

4. **Be Patient**: Understand that financial success takes time.

5. **Stay Motivated**: Keep your financial goals in sight.

6. **Be Proactive**: Take charge of your financial future.

7. **Embrace Change**: Be willing to adapt your strategies as needed.

8. **Learn Continuously**: Always seek to improve your financial knowledge.

9. **Avoid Procrastination**: Tackle financial tasks promptly.

10. **Be Resilient**: Bounce back from financial setbacks.

### Budgeting and Saving

11. **Create a Budget**: Track your income and expenses.

12. **Cut Unnecessary Expenses**: Identify and eliminate wasteful spending.

13. **Save Regularly**: Set aside a portion of your income every month.

14. **Build an Emergency Fund**: Aim for 3-6 months’ worth of expenses.

15. **Automate Savings**: Use automatic transfers to your savings account.

16. **Live Below Your Means**: Spend less than you earn.

17. **Review Subscriptions**: Cancel unused subscriptions.

18. **Plan for Large Purchases**: Save up rather than using credit.

19. **Track Spending**: Use apps or spreadsheets to monitor expenditures.

20. **Use Cash**: Avoid overspending by using cash instead of cards.

### Investing

21. **Start Early**: Take advantage of compound interest.

22. **Diversify Investments**: Spread your money across different asset classes.

23. **Understand Risks**: Know the risks associated with different investments.

24. **Invest Regularly**: Use dollar-cost averaging.

25. **Stay Informed**: Keep up with market trends and changes.

26. **Seek Professional Advice**: Consult with financial advisors.

27. **Invest in Index Funds**: Consider low-cost index funds for diversification.

28. **Reinvest Dividends**: Use dividends to purchase more shares.

29. **Avoid Market Timing**: Stick to your investment plan despite market fluctuations.

30. **Use Tax-Advantaged Accounts**: Maximize contributions to retirement accounts.

### Debt Management

31. **Understand Your Debt**: Know the terms and interest rates of your debts.

32. **Prioritize High-Interest Debt**: Pay off high-interest debt first.

33. **Consolidate Loans**: Consider loan consolidation for better rates.

34. **Avoid New Debt**: Resist taking on additional debt.

35. **Negotiate Rates**: Ask for lower interest rates on your credit cards.

36. **Make Extra Payments**: Pay more than the minimum on your debts.

37. **Track Due Dates**: Keep a calendar of payment due dates.

38. **Avoid Payday Loans**: Steer clear of high-interest payday loans.

39. **Use Windfalls Wisely**: Apply bonuses or tax refunds to debt.

40. **Educate Yourself**: Learn about debt management strategies.

### Earning More

41. **Enhance Skills**: Invest in education and skill development.

42. **Seek Promotions**: Take on new challenges at work.

43. **Negotiate Salary**: Don’t be afraid to ask for a raise.

44. **Start a Side Hustle**: Explore additional income streams.

45. **Network**: Build professional relationships that can lead to opportunities.

46. **Offer Freelance Services**: Use your skills to freelance.

47. **Invest in Certifications**: Gain certifications that can boost your career.

48. **Monetize Hobbies**: Turn hobbies into income-generating activities.

49. **Teach or Tutor**: Share your knowledge for a fee.

50. **Rent Out Assets**: Rent out a room, car, or other assets for extra income.

### Retirement Planning

51. **Start Early**: Begin saving for retirement as soon as possible.

52. **Maximize Contributions**: Contribute the maximum to retirement accounts.

53. **Understand Your Plan**: Know the details of your retirement plan.

54. **Diversify Retirement Savings**: Use various types of retirement accounts.

55. **Calculate Needs**: Estimate how much you’ll need in retirement.

56. **Review Regularly**: Periodically review and adjust your retirement plan.

57. **Delay Social Security**: Consider delaying Social Security for higher benefits.

58. **Consider Healthcare Costs**: Plan for healthcare expenses in retirement.

59. **Reduce Debt**: Aim to enter retirement with minimal debt.

60. **Stay Active**: Engage in part-time work or hobbies during retirement.

### Family and Lifestyle

61. **Involve Family**: Discuss financial goals with your family.

62. **Teach Kids About Money**: Educate children on financial literacy.

63. **Plan for Education**: Save for children’s education expenses.

64. **Plan Family Activities**: Budget for vacations and family activities.

65. **Live Simply**: Embrace a minimalist lifestyle.

66. **Avoid Peer Pressure**: Make financial decisions based on your goals, not others.

67. **Plan for Big Life Events**: Budget for weddings, births, and other significant events.

68. **Create Traditions**: Develop low-cost family traditions.

69. **Be Charitable**: Include charitable giving in your financial plan.

70. **Take Care of Health**: Preventive healthcare can save money in the long run.

### Financial Tools and Technology

71. **Use Financial Apps**: Leverage technology for budgeting and saving.

72. **Monitor Credit Score**: Regularly check your credit score.

73. **Use Rewards Programs**: Benefit from credit card rewards and loyalty programs.

74. **Set Alerts**: Use alerts to track spending and account balances.

75. **Secure Your Information**: Protect your financial information online.

76. **Shop Around**: Compare prices before making purchases.

77. **Take Advantage of Sales**: Plan purchases around sales and discounts.

78. **Use Coupons**: Utilize coupons and cashback apps.

79. **Stay Organized**: Keep financial documents organized.

80. **Review Policies**: Regularly review insurance and service policies for savings.

### Long-term Strategies

81. **Plan Estate**: Create a will and plan your estate.

82. **Invest in Real Estate**: Consider real estate as part of your portfolio.

83. **Diversify Income**: Develop multiple income streams.

84. **Prepare for Inflation**: Consider inflation in your financial planning.

85. **Plan for Tax Efficiency**: Use tax-efficient investment strategies.

86. **Create Passive Income**: Invest in assets that generate passive income.

87. **Consider Annuities**: Evaluate annuities for retirement income.

88. **Insure Adequately**: Ensure you have adequate insurance coverage.

89. **Invest in Yourself**: Continuously improve your skills and knowledge.

90. **Network with Peers**: Engage with like-minded individuals for advice and support.

### Health and Wellness

91. **Maintain Health**: Healthy living can reduce medical expenses.

92. **Exercise Regularly**: Physical fitness contributes to overall well-being.

93. **Eat Well**: A balanced diet can prevent costly health issues.

94. **Get Enough Sleep**: Adequate rest improves productivity and decision-making.

95. **Manage Stress**: Reducing stress can improve your financial decision-making.

96. **Avoid Addictions**: Avoid costly addictions such as smoking and excessive drinking.

97. **Seek Preventive Care**: Regular check-ups can prevent more significant issues.

98. **Stay Active**: Engaging in physical activities can be low-cost and healthy.

99. **Practice Mindfulness**: Mindfulness can improve financial and personal well-being.

100. **Build Strong Relationships**: Healthy relationships contribute to overall life satisfaction.

### Community and Giving

101. **Engage in Community**: Participate in community activities and support local businesses.

### Summary

Financial success is a multifaceted goal that requires a blend of positive attitudes, disciplined practices, and informed decisions. This guide covers 101 ways to enhance financial health across various life aspects, providing a comprehensive roadmap to achieving financial stability and growth.

### Conclusion

Achieving financial success is a journey that involves continuous learning, discipline, and adaptability. By adopting the right attitudes and strategies, individuals can secure their financial future, enjoy a higher quality of life, and be prepared for any uncertainties that come their way. This guide serves as a starting point, offering practical advice and insights to help navigate the path to financial success in 2024 and beyond. Each of these tips, when applied thoughtfully and consistently, can help pave the way to financial success in 2024 and beyond.

*Thank You Very Much With Warm Gratitude *