The Excellent Art of Forex Trading Strategies for Profitable Trades in 2024

Friends , Hello there, aspiring traders and curious minds! If you've ever wondered how people can make money from the comfort of their homes, you might want to learn more about forex trading. In 2024, the world of forex trading is more exciting and accessible than ever, and learning the right strategies can help you achieve profitable trades. Let's dive into the fascinating world of forex trading and explore how you can start your journey towards financial independence.

Friends , Hello there, aspiring traders and curious minds! If you've ever wondered how people can make money from the comfort of their homes, you might want to learn more about forex trading. In 2024, the world of forex trading is more exciting and accessible than ever, and learning the right strategies can help you achieve profitable trades. Let's dive into the fascinating world of forex trading and explore how you can start your journey towards financial independence.

Introduction

Forex, short for foreign exchange, is the largest financial market in the world, where currencies are bought and sold. With a daily trading volume exceeding $6 trillion, forex offers endless opportunities for profit. However, like any other form of trading, success in forex requires knowledge, discipline, and a well-thought-out strategy.

In this blog, we'll explore the fundamentals of forex trading, why it's important to learn effective strategies, the pros and cons of trading, and how you can get started on your journey to becoming a successful forex trader in 2024.

Forex, short for foreign exchange, is the largest financial market in the world, where currencies are bought and sold. With a daily trading volume exceeding $6 trillion, forex offers endless opportunities for profit. However, like any other form of trading, success in forex requires knowledge, discipline, and a well-thought-out strategy.

In this blog, we'll explore the fundamentals of forex trading, why it's important to learn effective strategies, the pros and cons of trading, and how you can get started on your journey to becoming a successful forex trader in 2024.

The Importance of Forex Trading Strategies

Forex trading strategies are crucial for achieving consistent profits and minimizing risks. In a market as dynamic as forex, where prices fluctuate rapidly, having a solid strategy can make all the difference. Here are a few reasons why developing a trading strategy is important:

- Consistency: A well-defined strategy helps you make consistent trading decisions, reducing the impact of emotional and impulsive actions.

- Risk Management: Strategies often include risk management techniques, helping you protect your capital from significant losses.

- Identifying Opportunities: Strategies help you identify entry and exit points, allowing you to capitalize on market movements.

- Building Confidence: Having a strategy gives you confidence in your trading decisions, which is essential for long-term success.

Forex trading strategies are crucial for achieving consistent profits and minimizing risks. In a market as dynamic as forex, where prices fluctuate rapidly, having a solid strategy can make all the difference. Here are a few reasons why developing a trading strategy is important:

- Consistency: A well-defined strategy helps you make consistent trading decisions, reducing the impact of emotional and impulsive actions.

- Risk Management: Strategies often include risk management techniques, helping you protect your capital from significant losses.

- Identifying Opportunities: Strategies help you identify entry and exit points, allowing you to capitalize on market movements.

- Building Confidence: Having a strategy gives you confidence in your trading decisions, which is essential for long-term success.

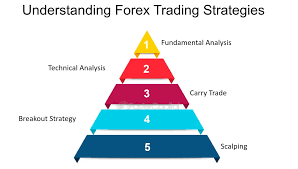

Fundamental Analysis Strategies

Economic Indicators Analysis

- Use indicators like GDP, unemployment rates, and inflation to anticipate currency movements.

Interest Rate Differentials

- Trade currencies based on the interest rate differentials between countries.

Geopolitical Events

- Monitor news and geopolitical events that can cause currency volatility.

Monetary Policy

- Analyze central bank policies for clues on future currency moves.

Trade Balances

- Study a country's trade balance to understand its economic strength and currency valuation.

Political Stability

- Assess the political environment of a country for potential impacts on its currency.

Commodity Prices

- Analyze the impact of commodity price changes (e.g., oil, gold) on commodity-linked currencies.

Government Debt Levels

- Consider the impact of national debt on a country’s currency value.

Foreign Direct Investment (FDI)

- Use FDI trends to gauge economic health and currency attractiveness.

Purchasing Power Parity (PPP)

- Use PPP to assess the relative value of currencies based on inflation.

Technical Analysis Strategies

Trend Following

- Identify and follow the prevailing market trend using moving averages.

Support and Resistance Levels

- Identify key support and resistance levels to make entry and exit decisions.

Candlestick Patterns

- Use patterns like doji, hammer, and engulfing to predict price reversals.

Moving Averages (MA)

- Use simple or exponential moving averages to smooth price data and identify trends.

Relative Strength Index (RSI)

- Use RSI to identify overbought or oversold conditions in the market.

Moving Average Convergence Divergence (MACD)

- Analyze MACD for trend direction and momentum.

Bollinger Bands

- Use Bollinger Bands to gauge market volatility and potential reversal points.

Fibonacci Retracement

- Apply Fibonacci retracement levels to identify potential support and resistance areas.

Ichimoku Cloud

- Use the Ichimoku Cloud for comprehensive trend and momentum analysis.

Stochastic Oscillator

- Use the stochastic oscillator to identify overbought or oversold conditions.

Elliott Wave Theory

- Apply Elliott Wave Theory to predict market cycles and trends.

Volume Analysis

- Use volume trends to confirm price movements and identify potential reversals.

Chart Patterns

- Identify chart patterns such as head and shoulders, double tops, and triangles for potential trades.

Parabolic SAR

- Use the Parabolic SAR indicator to set trailing stop-losses.

ADX (Average Directional Index)

- Use ADX to measure the strength of a trend.

Risk Management Techniques

Position Sizing

- Use position sizing to control the amount of risk per trade.

Stop-Loss Orders

- Implement stop-loss orders to limit potential losses.

Risk-Reward Ratio

- Ensure a favorable risk-reward ratio (e.g., 1:2) for each trade.

Diversification

- Diversify your trading portfolio across multiple currency pairs.

Hedging

- Use hedging strategies to offset potential losses in other trades.

Leverage Management

- Manage leverage wisely to avoid large losses.

Volatility Assessment

- Adjust position sizes based on market volatility.

Drawdown Control

- Implement strategies to minimize drawdowns in your trading account.

Capital Preservation

- Focus on preserving capital through disciplined risk management.

Trade Journal

- Keep a detailed trade journal to analyze and improve trading performance.

Trading Psychology

Emotional Discipline

- Develop emotional discipline to stick to your trading plan.

Patience

- Be patient and wait for high-probability trading setups.

Avoid Overtrading

- Resist the urge to overtrade and focus on quality trades.

Set Realistic Goals

- Set achievable trading goals and review them regularly.

Learn from Mistakes

- Analyze and learn from past trading mistakes.

Maintain a Positive Mindset

- Cultivate a positive mindset to stay motivated and focused.

Stay Adaptable

- Be willing to adapt your strategies based on market conditions.

Focus on Process, Not Outcome

- Concentrate on executing your trading plan rather than the results.

Avoid Impulse Trades

- Avoid making impulsive trades based on emotions.

Continuous Learning

- Commit to ongoing learning and improvement in your trading skills.

Advanced Strategies

Algorithmic Trading

- Develop or use algorithmic trading systems for automated trading.

High-Frequency Trading (HFT)

- Engage in high-frequency trading to capitalize on small price movements.

Scalping

- Use scalping strategies to make quick profits from small price changes.

Swing Trading

- Capture short- to medium-term price movements with swing trading strategies.

Position Trading

- Hold positions for the long term based on fundamental analysis.

Carry Trade

- Profit from interest rate differentials by holding high-yield currencies.

Grid Trading

- Implement grid trading strategies to profit from ranging markets.

News Trading

- Trade around major news releases to capture volatility.

Arbitrage

- Use arbitrage opportunities between currency pairs for risk-free profits.

Correlation Trading

- Use currency correlations to hedge or enhance trading positions.

Market Environment Strategies

Range Trading

- Identify and trade within established price ranges.

Breakout Trading

- Trade breakouts from key support or resistance levels.

Trend Reversal

- Identify potential trend reversals and trade accordingly.

Momentum Trading

- Use momentum indicators to trade strong price movements.

Volatility Trading

- Capitalize on increased volatility with volatility-based strategies.

Session Trading

- Trade based on different forex market sessions (e.g., London, New York).

Seasonal Patterns

- Identify and trade seasonal patterns in the forex market.

Event-Driven Trading

- Trade is based on specific events, such as elections or economic reports.

Market Sentiment

- Analyze market sentiment to gauge overall investor confidence.

Supply and Demand

- Use supply and demand analysis to identify potential price levels.

Technological Tools and Platforms

Trading Platforms

- Use advanced trading platforms with comprehensive tools and features.

Charting Software

- Utilize charting software with technical indicators and analysis tools.

Economic Calendar

- Stay informed with an economic calendar for upcoming events.

Social Trading

- Follow successful traders and copy their trades through social trading platforms.

Backtesting

- Backtest trading strategies using historical data to assess their effectiveness.

Demo Trading

- Practice trading with a demo account before risking real capital.

Mobile Trading

- Use mobile trading apps for flexibility and convenience.

Trade Alerts

- Set up trade alerts to stay informed of market changes.

Automated Trading Systems

- Develop automated systems to execute trades based on pre-defined criteria.

Custom Indicators

- Create custom indicators to suit your trading style.

Educational Resources and Community

Forex Courses

- Enroll in forex courses to improve your knowledge and skills.

Trading Forums

- Participate in trading forums to exchange ideas and strategies.

Webinars

- Attend webinars hosted by experienced traders and analysts.

Mentorship

- Seek mentorship from experienced traders to accelerate your learning.

Trading Books

- Read books by renowned traders and authors to gain insights.

Podcasts

- Listen to trading podcasts for tips and market updates.

Online Communities

- Join online communities to connect with other traders.

Market Analysis Reports

- Subscribe to market analysis reports for professional insights.

Trading Blogs

- Follow trading blogs for daily tips and strategies.

YouTube Channels

- Watch educational videos on YouTube for practical trading advice.

Portfolio Management

Asset Allocation

- Diversify your trading portfolio across different asset classes.

Rebalancing

- Regularly rebalance your portfolio to maintain your desired risk level.

Performance Review

- Conduct regular performance reviews to assess and adjust strategies.

Investment Horizon

- Define your investment horizon and adjust strategies accordingly.

Risk Assessment

- Continually assess and adjust risk levels based on market conditions.

Specialized Trading Strategies

Quantitative Analysis

- Use quantitative analysis and models for data-driven trading.

Mean Reversion

- Trade is based on the concept that prices will revert to their mean over time.

Currency Baskets

- Trade currency baskets to diversify exposure and reduce risk.

GAP Trading

- Exploit price gaps that occur between trading sessions.

Options Strategies

- Use forex options strategies for hedging and speculation.

Sentiment Analysis

- Use sentiment analysis to gauge market mood and potential reversals.

Liquidity Analysis

- Analyze liquidity conditions to determine optimal trade times.

Inverse Trading

- Trade inversely correlated pairs to hedge risk.

Time-Based Strategies

- Develop time-based strategies focusing on specific market hours.

Event Forecasting - Predict market movements based on event forecasts and scenarios.

Sustainable Trading - Incorporate sustainable and ethical factors into trading decisions.

Pros of Forex Trading

Forex trading offers several advantages that make it an attractive option for many individuals:

- Accessibility: The forex market is open 24 hours a day, five days a week, allowing you to trade at your convenience, whether you're a night owl or an early bird.

- Leverage: Forex brokers offer leverage, allowing you to control larger positions with a relatively small amount of capital. This can amplify your profits.

- Liquidity: With its high trading volume, the forex market is highly liquid, ensuring that you can enter and exit trades quickly.

- Diverse Strategies: There are numerous trading strategies to explore, from technical analysis to fundamental analysis, catering to different trading styles.

Cons of Forex Trading

While forex trading offers many benefits, it's important to be aware of the potential drawbacks:

- Volatility: The forex market is highly volatile, and prices can change rapidly, leading to potential losses.

- Complexity: Understanding forex trading requires a learning curve, as it involves analyzing economic data, charts, and market trends.

- Risk of Over-Leveraging: While leverage can increase profits, it can also lead to significant losses if not used carefully.

- Emotional Challenges: Trading can be emotionally demanding, requiring discipline and patience to avoid impulsive decisions.

Getting Started with Forex Trading

Embarking on your forex trading journey in 2024 is easier than ever, thanks to the abundance of resources and platforms available. Here are some steps to get started:

Educate Yourself: Start by learning the basics of forex trading, including key terms, market mechanics, and trading platforms. There are plenty of online courses, tutorials, and books available.

Choose a Reliable Broker: Select a reputable forex broker that suits your trading needs. Look for features like low spreads, user-friendly platforms, and educational resources.

Develop a Trading Plan: Create a trading plan that outlines your goals, risk tolerance, and strategies. Having a clear plan helps you stay focused and disciplined.

Practice with a Demo Account: Before trading with real money, practice using a demo account to gain experience and test your strategies without risking your capital.

Start Small: When you're ready to trade with real money, start with a small amount that you can afford to lose. Gradually increase your position size as you gain confidence and experience.

SummaryThis guide provides a broad overview of various forex trading strategies and concepts to consider in 2024. Each strategy can be explored and customized based on your trading style and risk tolerance. Remember that consistent success in forex trading requires continuous learning, adaptation, and discipline.

This guide provides a broad overview of various forex trading strategies and concepts to consider in 2024. Each strategy can be explored and customized based on your trading style and risk tolerance. Remember that consistent success in forex trading requires continuous learning, adaptation, and discipline.

Forex trading is an exciting and potentially lucrative endeavor that offers the opportunity to earn money from anywhere in the world. By learning the art of forex trading strategies, you can navigate the market with confidence and increase your chances of profitable trades. Remember, success in forex requires dedication, continuous learning, and a well-defined strategy.

Conclusion

Thank you for joining me on this journey into the fascinating world of forex trading. I hope this blog has inspired you to explore the possibilities and take your first steps towards becoming a successful forex trader. Happy trading!