101 Easy and SMART Ways for Financial Goals to Achieve Financial Freedom in 2024

Introduction

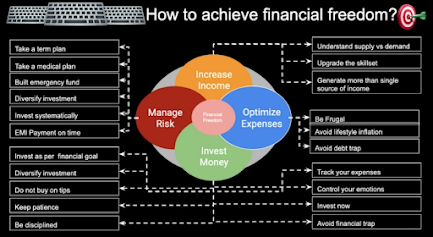

Achieving financial freedom is a dream for many, representing the ability to live life on your terms without financial stress. Setting and achieving SMART (Specific, Measurable, Achievable, Relevant, Time-bound) financial goals is a powerful strategy to reach this objective.

This guide provides 101 easy and SMART financial goals to help you achieve financial freedom in 2024.

Importance of Financial Freedom

- Stress Reduction: Financial freedom alleviates the stress associated with money worries.

- Life Choices: Enables you to make choices based on desire rather than necessity.

- Security: Provides a safety net for unexpected life events.

- Retirement: Ensures a comfortable and independent retirement.

- Legacy: Allows you to leave a financial legacy for your loved ones.

Overview of SMART Financial Goals

Specific

- Create a Monthly Budget: Outline all income and expenses to track spending.

- Build an Emergency Fund: Save at least three to six months’ worth of expenses.

- Pay Off Credit Card Debt: Clear all credit card debt by a specific date.

- Save for a Vacation: Allocate funds each month towards a planned trip.

- Invest in Retirement Accounts: Contribute a specific amount to a 401(k) or IRA.

- Start a Side Hustle: Generate an additional income stream through freelancing or a small business.

- Save for a Down Payment: Set aside a specific amount monthly for a home down payment.

- Create a College Fund: Start saving for children’s education.

- Invest in Stocks: Allocate a fixed amount each month to a stock market portfolio.

- Automate Savings: Set up automatic transfers to savings accounts.

Measurable

- Track Net Worth Monthly: Use financial software to monitor net worth growth.

- Reduce Monthly Expenses by 10%: Cut non-essential spending.

- Achieve a Credit Score of 750+: Improve creditworthiness.

- Save $5,000 for a Major Purchase: Plan and save for a specific big-ticket item.

- Increase Savings Rate by 5%: Incrementally increase the percentage of income saved.

- Earn $500 Monthly in Passive Income: Invest in income-generating assets.

- Pay Off Student Loans: Set a target date to clear educational debts.

- Save for a Car: Allocate funds for a vehicle purchase without loans.

- Contribute $200 Monthly to Charity: Include charitable giving in your budget.

- Earn a Professional Certification: Enhance career prospects through education.

Achievable

- Reduce Dining Out: Limit restaurant visits to save money.

- Increase 401(k) Contributions by 2%: Gradually raise retirement savings.

- Complete a Financial Literacy Course: Improve financial knowledge.

- Declutter and Sell Unused Items: Generate cash by selling unwanted belongings.

- Set Up a Roth IRA: Start a retirement account for tax-free growth.

- Negotiate Lower Bills: Contact service providers to lower monthly costs.

- Invest in Index Funds: Choose low-cost, diversified investment options.

- Read a Financial Book Monthly: Enhance financial literacy.

- Join an Investment Club: Learn and invest with like-minded individuals.

- Track Spending with an App: Use technology to manage finances.

Relevant

- Align Goals with Life Plans: Ensure financial goals support personal ambitions.

- Create a Will and Estate Plan: Protect assets and plan for future generations.

- Set a Retirement Age Goal: Decide on a target age for retirement planning.

- Develop a Health Savings Account (HSA): Save for future medical expenses.

- Buy Income-Generating Properties: Invest in real estate for rental income.

- Plan for Children’s Expenses: Budget for school fees and activities.

- Diversify Investments: Spread risk across different asset classes.

- Build a Professional Network: Connect with professionals to enhance career opportunities.

- Implement a Tax Strategy: Optimize savings and investments for tax efficiency.

- Focus on Debt-Free Living: Prioritize paying off all forms of debt.

Time-bound

- Save $10,000 in One Year: Set a timeline and specific monthly savings goal.

- Achieve $1,000 in Passive Income in Six Months: Invest in income-generating assets.

- Increase Income by 20% in Two Years: Pursue career advancements or side businesses.

- Pay Off Car Loan in One Year: Allocate extra payments towards clearing the loan.

- Max Out IRA Contributions This Year: Reach the annual contribution limit.

- Buy a Home in Five Years: Plan and save for a property purchase.

- Reduce Debt by 50% in One Year: Aggressively pay down outstanding debts.

- Build a $50,000 Retirement Fund in Five Years: Set aside regular contributions.

- Save for a $5,000 Emergency Fund in Six Months: Prioritize short-term savings.

- Earn $1,000 from Side Hustle in One Year: Develop and grow a part-time business.

Additional Goals (51-101)

- Set Up a Monthly Budget Review: Regularly assess and adjust your budget.

- Start a Family Financial Meeting: Discuss and align family financial goals.

- Invest in a High-Yield Savings Account: Maximize interest on savings.

- Set Up Automatic Bill Payments: Avoid late fees by automating payments.

- Review Insurance Policies: Ensure adequate coverage and compare rates.

- Create a Financial Vision Board: Visualize and stay motivated towards goals.

- Track Your Financial Goals Progress: Use a tracker or spreadsheet.

- Invest in a Tax-Advantaged Account: Utilize accounts like 529 plans for education.

- Set Quarterly Financial Check-Ins: Regularly assess financial health.

- Reduce Housing Costs: Consider downsizing or refinancing.

- Cut Utility Costs: Implement energy-saving measures to reduce bills.

- Cook More at Home: Save money by eating out less.

- Increase Emergency Fund to One Year: Expand savings for added security.

- Start a No-Spend Challenge: Limit spending for a set period.

- Use Cashback Apps: Earn rewards on everyday purchases.

- Plan and Save for Holidays: Budget and save for holiday expenses.

- Take Advantage of Employer Benefits: Maximize health, retirement, and other benefits.

- Set Up a Travel Fund: Save regularly for future travel.

- Invest in Self-Education: Allocate funds for courses and training.

- Plan for Major Life Events: Budget for weddings, births, etc.

- Improve Home to Increase Value: Invest in home improvements.

- Seek Professional Financial Advice: Consult with a financial advisor.

- Stay Informed About Financial News: Keep up with economic trends.

- Invest in Dividend Stocks: Generate passive income through dividends.

- Utilize Tax Deductions and Credits: Maximize tax savings.

- Create a Charitable Giving Plan: Budget and plan for donations.

- Review and Adjust Financial Goals Annually: Ensure they stay relevant.

- Invest in Peer-to-Peer Lending: Diversify income streams.

- Plan for Health Expenses: Budget for regular and unexpected health costs.

- Set a Savings Goal for Every Month: Keep savings consistent.

- Track and Celebrate Milestones: Reward progress towards financial goals.

- Automate Investments: Set up automatic transfers to investment accounts.

- Participate in Financial Webinars: Continuously educate yourself.

- Eliminate Unnecessary Subscriptions: Cut costs on unused services.

- Plan for Tax Season Early: Prepare and organize tax documents ahead of time.

- Invest in Renewable Energy: Save on utility bills and earn incentives.

- Utilize Financial Apps: Simplify budgeting and investing with technology.

- Focus on Long-Term Investments: Prioritize sustainable growth.

- Create a Debt Repayment Plan: Strategize and prioritize paying off debts.

- Save for a Big Purchase: Plan and save for future large expenses.

- Improve Credit Utilization Ratio: Keep credit card balances low.

- Invest in Real Estate: Consider property investment for income and growth.

- Contribute to a Spousal IRA: Maximize retirement savings as a couple.

- Set Up a 529 Plan for Education: Save for children’s college expenses.

- Create a Financial Bucket List: Identify and plan for financial goals and dreams.

- Invest in Cryptocurrencies: Explore and invest in digital assets cautiously.

- Monitor and Reduce Interest Rates: Refinance loans to lower interest rates.

- Develop a Philanthropic Goal: Plan and budget for charitable contributions.

- Prepare for Job Loss: Save and plan for potential employment gaps.

- Stay Motivated with Financial Quotes: Inspire yourself with motivational quotes.

- Teach Financial Literacy to Family: Share knowledge to ensure family financial health.

Pros and Cons

Pros:

- Clear Direction: SMART goals provide a clear path and measurable outcomes.

- Motivation: Specific and achievable targets keep you motivated.

- Accountability: Measurable and time-bound goals help track progress.

- Financial Security: Systematic saving and investing lead to long-term security.

- Balanced Life: Financial freedom allows for a more balanced and fulfilling life.

Cons:

- Discipline Required: Achieving these goals requires consistent effort and discipline.

- Market Risks: Investments in stocks, crypto, or real estate carry market risks.

- Unexpected Expenses: Unforeseen costs can disrupt financial plans.

- Time-Intensive: Regular monitoring and adjusting of goals can be time-consuming.

- Initial Learning Curve: Understanding financial concepts and investment strategies can be challenging initially.

Conclusion

Achieving financial freedom is a lifelong journey that requires setting and attaining SMART goals. By focusing on specific, measurable, achievable, relevant, and time-bound objectives, you can systematically improve your financial situation and work towards a future of financial independence. While the path may present challenges, the rewards of peace of mind, flexibility, and the ability to pursue your passions make it worthwhile.

Thank You

Thank you for exploring this guide on achieving financial freedom through SMART goals. We hope these ideas inspire and guide you toward a prosperous and financially secure future. Remember, the key to success lies in consistent effort, continuous learning, and strategic planning. Best of luck on your journey to financial freedom in 2024 and beyond!