121 Factors Affecting Global Corporation Financial Growth in 2024

### Introduction

The modern digital landscape has transformed the way corporations operate, grow, and compete. With rapid advancements in technology and a shift towards a digital-first approach, businesses must adapt to new strategies and tools to ensure sustained financial growth. This includes leveraging digital skills, Fintech innovations, digital marketing, and cloud computing, all while aiming for financial freedom through passive income streams. In this comprehensive guide, we will explore these facets and provide an overview of the 121 factors affecting global corporation financial growth in 2024.

### Digital Skills

Digital skills are essential in today's business environment. They encompass a wide range of competencies, from basic computer literacy to advanced data analytics and cybersecurity. Mastery of digital skills enables employees and leaders to leverage technology efficiently, driving innovation, improving productivity, and maintaining a competitive edge.

### Fintech

Financial Technology (Fintech) has revolutionized the financial services industry. By integrating technology with financial services, Fintech has made transactions faster, more secure, and more accessible. Key areas include mobile banking, digital payments, blockchain, and online lending platforms. These innovations have reshaped the way businesses manage finances and interact with customers.

### Make Money

In the digital age, there are myriad ways to generate income online. From e-commerce and affiliate marketing to online courses and content creation, digital platforms offer vast opportunities for revenue generation. Businesses can diversify their income streams and tap into global markets with relative ease.

### Digital Transformation with Google Cloud

Google Cloud provides a suite of tools and services that facilitate digital transformation. By migrating to the cloud, businesses can enhance their data storage, processing, and analytics capabilities. Google Cloud's robust infrastructure supports scalable solutions, enabling businesses to innovate and grow efficiently.

### Passive Income and Financial Freedom

Achieving financial freedom often involves creating passive income streams. These are income sources that require minimal ongoing effort, such as investments, rental income, or royalties from intellectual property. Passive income allows individuals and businesses to build wealth and reduce dependence on active income sources.

### Digital Marketing

Digital marketing is crucial for reaching and engaging customers in today's online-centric world. It involves strategies such as search engine optimization (SEO), social media marketing, email campaigns, and content marketing. Effective digital marketing can drive brand awareness, increase sales, and foster customer loyalty.

### Importance

Understanding and implementing these digital strategies is vital for modern corporations. It ensures they remain competitive, relevant, and capable of meeting the demands of an increasingly digital consumer base.

### Objective

The objective of this guide is to provide a comprehensive overview of the various digital strategies and factors that influence global corporation financial growth. By understanding these elements, businesses can better prepare for the challenges and opportunities of 2024.

### Overviews

We will explore the psychological impacts of digital transformation, the pros and cons of various digital strategies, and provide a framework for understanding corporate-level strategies in the context of the 121 factors affecting financial growth.

### Psychology

The psychology of digital transformation involves understanding how employees and customers adapt to technological changes. It requires fostering a culture of continuous learning and innovation, as well as managing resistance to change effectively.

### Pros and Cons

#### Pros

1. **Increased Efficiency**

2. **Enhanced Customer Experience**

3. **Greater Market Reach**

4. **Improved Data Analytics**

5. **Scalability and Flexibility**

#### Cons

1. **Security Risks**

2. **High Initial Costs**

3. **Dependence on Technology**

4. **Need for Continuous Upgrades**

5. **Potential Job Displacement**

### Corporate Level Strategies: Definition, Meaning & Framework

Corporate-level strategies define the overarching direction of an organization and how it intends to achieve its long-term objectives. This involves decisions about which markets to enter, how to allocate resources, and how to manage various business units. A robust corporate strategy aligns with the broader goals of the organization, ensuring cohesive and strategic growth.

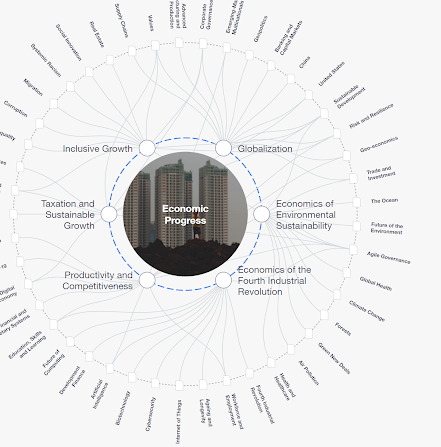

### 121 Factors Affecting Global Corporation Financial Growth in 2024

As detailed earlier, these factors span across macroeconomic, technological, political, environmental, social, industry-specific, financial, and legal domains. Understanding and navigating these factors is crucial for achieving sustainable financial growth in an ever-evolving global market.

In 2024, several factors are influencing the financial growth of global corporations. These factors can be categorized into macroeconomic, technological, political, environmental, and social influences. Here's a detailed list of 121 factors affecting global corporation financial growth in 2024:

### Macroeconomic Factors

1. **Global GDP Growth**

2. **Interest Rates**

3. **Inflation Rates**

4. **Exchange Rate Volatility**

5. **Unemployment Rates**

6. **Commodity Prices**

7. **Trade Balances**

8. **Economic Policies**

9. **Fiscal Policies**

10. **Monetary Policies**

11. **Debt Levels**

12. **Consumer Confidence**

13. **Investment Rates**

14. **Savings Rates**

15. **Regional Economic Disparities**

### Technological Factors

16. **Innovation and R&D**

17. **Artificial Intelligence and Automation**

18. **Blockchain Technology**

19. **Cybersecurity Threats**

20. **Digital Transformation**

21. **5G and Connectivity**

22. **Internet of Things (IoT)**

23. **Cloud Computing**

24. **Big Data Analytics**

25. **E-commerce Growth**

26. **Technology Adoption Rates**

27. **Patents and Intellectual Property**

28. **Tech Startups and Disruption**

### Political Factors

29. **Government Stability**

30. **Regulatory Changes**

31. **Trade Policies and Tariffs**

32. **Political Relations**

33. **Taxation Policies**

34. **Bilateral and Multilateral Agreements**

35. **Sanctions and Embargoes**

36. **Geopolitical Tensions**

37. **National Security Policies**

38. **Corruption Levels**

39. **Policy Uncertainty**

40. **Public-Private Partnerships**

### Environmental Factors

41. **Climate Change**

42. **Sustainability Practices**

43. **Environmental Regulations**

44. **Resource Scarcity**

45. **Carbon Emissions**

46. **Renewable Energy Adoption**

47. **Pollution Control Measures**

48. **Green Technology Investments**

49. **Climate-related Disasters**

50. **Waste Management Policies**

51. **Environmental, Social, and Governance (ESG) Criteria**

### Social Factors

52. **Demographic Shifts**

53. **Urbanization Trends**

54. **Education and Skill Levels**

55. **Health Trends**

56. **Consumer Preferences**

57. **Cultural Trends**

58. **Social Movements**

59. **Income Inequality**

60. **Labor Market Dynamics**

61. **Workforce Diversity**

62. **Corporate Social Responsibility**

63. **Migration Patterns**

64. **Public Health Crises**

### Industry-Specific Factors

65. **Market Competition**

66. **Industry Regulation**

67. **Barriers to Entry**

68. **Product Demand**

69. **Supply Chain Efficiency**

70. **Distribution Channels**

71. **Customer Loyalty**

72. **Brand Reputation**

73. **Mergers and Acquisitions**

74. **Innovation Cycles**

75. **Price Wars**

76. **Quality Standards**

77. **After-sales Services**

78. **Customer Satisfaction**

### Financial Factors

79. **Access to Capital**

80. **Credit Ratings**

81. **Investment in Assets**

82. **Cash Flow Management**

83. **Profit Margins**

84. **Debt Management**

85. **Dividend Policies**

86. **Stock Market Performance**

87. **Financial Reporting Standards**

88. **Cost Management**

89. **Hedging Strategies**

90. **Financial Risk Management**

91. **Liquidity Ratios**

92. **Return on Investment (ROI)**

### Technological Adoption and Integration

93. **Adoption of Fintech Solutions**

94. **Digital Payment Systems**

95. **E-commerce Platform Integration**

96. **Supply Chain Digitalization**

97. **Customer Relationship Management Systems**

98. **Enterprise Resource Planning (ERP) Systems**

99. **Social Media Marketing**

100. **Remote Working Technologies**

101. **Virtual and Augmented Reality Applications**

102. **Robotics in Manufacturing**

103. **Automation of Administrative Tasks**

### Legal Factors

104. **Compliance with International Laws**

105. **Intellectual Property Rights**

106. **Labor Laws and Standards**

107. **Antitrust Laws**

108. **Consumer Protection Laws**

109. **Environmental Laws**

110. **Data Protection Regulations**

111. **Dispute Resolution Mechanisms**

### Market Dynamics

112. **Emerging Markets Growth**

113. **Market Saturation Levels**

114. **Consumer Spending Power**

115. **Product Innovation**

116. **Marketing and Advertising Strategies**

117. **Brand Loyalty Programs**

118. **Pricing Strategies**

119. **Seasonal Demand Fluctuations**

120. **Global Supply Chain Resilience**

121. **Competitive Benchmarking**

### Summary

Digital skills, Fintech, digital marketing, and cloud computing are key drivers of financial growth for global corporations. Understanding and leveraging these elements can lead to significant competitive advantages and sustainable financial success. These factors collectively shape the financial landscape for global corporations, requiring strategic adaptation and forward-thinking to ensure sustained growth and profitability.

### Conclusion

In conclusion, the digital landscape presents both opportunities and challenges for global corporations. By embracing digital transformation, enhancing digital skills, and strategically utilizing tools like Google Cloud and digital marketing, businesses can thrive in 2024 and beyond. Acknowledging the 121 factors affecting financial growth is essential for informed decision-making and strategic planning.

### Thank You Very Much With Warm Gratitude

Thank you for engaging with this comprehensive guide. Your interest and dedication to understanding the dynamics of digital transformation and financial growth are highly appreciated. With warm gratitude, we hope this guide serves as a valuable resource for your strategic endeavors.

These factors collectively shape the financial landscape for global corporations, requiring strategic adaptation and forward-thinking to ensure sustained growth and profitability.

No comments:

Post a Comment