101 ways in which Artificial Intelligence (AI), Machine Learning (ML), and Big Data are impacting financial analysis in 2024

**Introduction**

In the rapidly evolving financial landscape of 2024, Artificial Intelligence (AI), Machine Learning (ML), and Big Data have emerged as transformative forces. These technologies are reshaping financial analysis, providing new insights, enhancing efficiency, and driving innovation. The integration of these advanced tools within the realm of Fintech is a pivotal aspect of the broader digital transformation that is revolutionizing the finance sector. This comprehensive guide explores 101 ways AI, ML, and Big Data are making a significant impact on financial analysis, fostering opportunities for making money, achieving passive income, and attaining financial freedom.

**Artificial Intelligence (AI)**

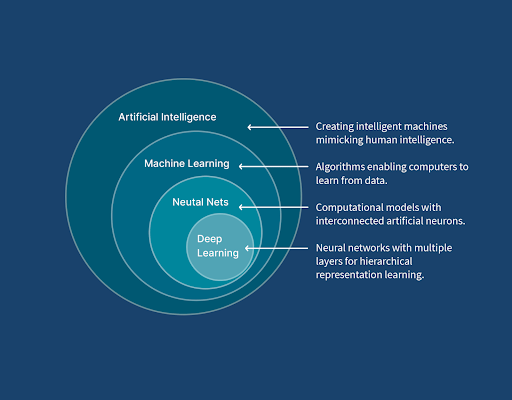

AI refers to the simulation of human intelligence processes by machines, particularly computer systems. In finance, AI is used to analyze vast amounts of data quickly and accurately, automate complex processes, and create predictive models that inform decision-making. AI's capabilities include natural language processing (NLP), machine learning, and robotics, all of which contribute to enhanced financial analysis.

**Big Data**

Big Data refers to the enormous volume, velocity, and variety of data that traditional data processing tools cannot handle efficiently. In financial analysis, Big Data encompasses transaction data, market data, social media feeds, and other alternative data sources. The ability to analyze and derive insights from Big Data allows financial institutions to identify trends, predict outcomes, and make informed decisions.

**Machine Learning (ML)**

ML is a subset of AI that enables systems to learn from data, identify patterns, and make decisions with minimal human intervention. In finance, ML algorithms are employed for tasks such as risk assessment, fraud detection, algorithmic trading, and customer segmentation. The adaptive nature of ML models allows them to improve over time, providing increasingly accurate and valuable insights.

**Fintech**

Fintech, or financial technology, refers to the integration of technology into offerings by financial services companies to improve their use and delivery to consumers. The convergence of AI, Big Data, and ML within Fintech is driving innovation and creating new financial products and services. Fintech solutions are enhancing the efficiency of financial transactions, reducing costs, and improving customer experiences.

**Digital Transformation**

Digital transformation in finance involves the adoption of digital technologies to fundamentally change how financial institutions operate and deliver value to customers. AI, Big Data, and ML are at the core of this transformation, enabling automation, enhancing data analysis, and fostering innovation. Digital transformation aims to improve operational efficiency, enhance customer satisfaction, and create new revenue streams.

**Make Money, PASSIVE Income, Financial Freedom**

The integration of AI, ML, and Big Data in financial analysis offers numerous opportunities to make money, achieve passive income, and attain financial freedom. These technologies enable better investment strategies, improved risk management, and personalized financial advice, which can lead to increased profitability and financial security. By leveraging advanced analytical tools, individuals and businesses can make informed decisions that drive financial success.

**Digital Marketing**

Digital marketing in finance involves using digital channels to reach and engage customers. AI and Big Data play a crucial role in optimizing digital marketing strategies by analyzing customer behavior, personalizing marketing messages, and predicting future trends. These technologies enable financial institutions to target the right audience with the right message at the right time, enhancing marketing effectiveness and ROI.

**Importance, Objective, Overviews**

Understanding the importance and objectives of integrating AI, ML, and Big Data in financial analysis is crucial. These technologies enhance accuracy, efficiency, and decision-making capabilities. The objective is to leverage advanced analytics to gain deeper insights, improve financial performance, and create innovative financial products. An overview of their impact includes improved risk management, fraud detection, personalized banking, and enhanced investment strategies.

**Psychology**

The psychology behind the adoption of AI, ML, and Big Data in finance involves understanding human behavior and decision-making processes. These technologies analyze patterns in human behavior to predict future actions and provide insights into customer preferences. By understanding the psychological aspects of financial decision-making, institutions can create more effective and user-friendly financial products.

**Pros and Cons**

*Pros:*

1. Enhanced decision-making accuracy

2. Improved risk management

3. Increased operational efficiency

4. Personalized financial services

5. Faster and more accurate fraud detection

*Cons:*

1. High implementation costs

2. Data privacy concerns

3. Potential for algorithmic bias

4. Dependency on technology

5. Complexity of managing and analyzing large datasets

**101 Ways AI, ML, and Big Data are Impacting Financial Analysis in 2024**

1. **Algorithmic Trading**: Using AI to execute trades at optimal times.

2. **Fraud Detection**: Implementing ML algorithms to identify fraudulent transactions.

3. **Predictive Analytics**: Utilizing big data to forecast market trends.

4. **Risk Management**: Employing AI to assess and mitigate financial risks.

5. **Customer Segmentation**: Using ML to segment customers based on behavior.

6. **Personalized Banking**: Providing customized financial advice through AI.

7. **Credit Scoring**: Enhancing credit scoring models with big data insights.

8. **Sentiment Analysis**: Analyzing social media and news sentiment to predict market movements.

9. **Automated Compliance**: Ensuring regulatory compliance through AI-powered tools.

10. **Portfolio Management**: Using AI to optimize investment portfolios.

11. **Transaction Monitoring**: Real-time monitoring of transactions for suspicious activity.

12. **Loan Underwriting**: Using ML to improve loan approval processes.

13. **Market Analysis**: Leveraging big data to analyze and predict market behavior.

14. **Investment Strategy**: Developing AI-driven investment strategies.

15. **Quantitative Analysis**: Using ML for quantitative financial analysis.

16. **Chatbots**: Implementing AI chatbots for customer service in banking.

17. **Robo-Advisors**: Providing automated, algorithm-driven financial planning services.

18. **Blockchain Analysis**: Using AI to analyze blockchain transactions.

19. **Financial Modeling**: Enhancing financial models with ML techniques.

20. **Economic Forecasting**: Predicting economic indicators with AI.

21. **Customer Lifetime Value**: Estimating the lifetime value of customers using ML.

22. **Sales Forecasting**: Predicting sales trends through AI.

23. **Natural Language Processing (NLP)**: Using NLP to extract insights from financial reports.

24. **Data Visualization**: Enhancing data visualization techniques with big data.

25. **Insider Trading Detection**: Using AI to detect insider trading activities.

26. **Real-Time Analytics**: Providing real-time analytics for financial markets.

27. **RegTech Solutions**: Using AI to develop regulatory technology solutions.

28. **Behavioral Finance**: Applying ML to understand investor behavior.

29. **Alternative Data Sources**: Utilizing alternative data for financial analysis.

30. **Credit Risk Modeling**: Enhancing credit risk models with AI.

31. **Market Sentiment Indicators**: Creating market sentiment indicators using big data.

32. **High-Frequency Trading (HFT)**: Implementing AI in high-frequency trading.

33. **Operational Efficiency**: Increasing operational efficiency in financial services with AI.

34. **Customer Retention**: Using ML to predict and improve customer retention.

35. **AI-Driven Insights**: Generating insights from unstructured financial data.

36. **Financial Forecasting**: Enhancing financial forecasting accuracy with AI.

37. **Text Mining**: Extracting insights from text data in financial documents.

38. **Scenario Analysis**: Conducting scenario analysis using AI simulations.

39. **Stress Testing**: Performing stress tests on financial portfolios with AI.

40. **Big Data Integration**: Integrating various big data sources for comprehensive analysis.

41. **Anomaly Detection**: Identifying anomalies in financial data using ML.

42. **Investment Analysis**: Improving investment analysis with AI.

43. **Expense Management**: Automating expense management with AI.

44. **Revenue Optimization**: Using ML to optimize revenue streams.

45. **Regulatory Reporting**: Automating regulatory reporting with AI.

46. **Digital Transformation**: Driving digital transformation in finance with AI.

47. **Financial Planning**: Enhancing financial planning with ML.

48. **Dynamic Pricing**: Using AI for dynamic pricing strategies.

49. **Enhanced Due Diligence**: Improving due diligence processes with big data.

50. **Cross-Selling**: Using AI to identify cross-selling opportunities.

51. **Data Security**: Enhancing data security in financial institutions with AI.

52. **Peer Comparison**: Performing peer comparison analysis using big data.

53. **Transaction Analytics**: Analyzing transaction data for better insights.

54. **AI Ethics in Finance**: Ensuring ethical AI practices in financial services.

55. **Banking Fraud Analytics**: Implementing advanced fraud analytics in banking.

56. **Financial Text Analytics**: Extracting valuable information from financial texts.

57. **Predictive Maintenance**: Using AI for predictive maintenance in financial systems.

58. **AML Compliance**: Enhancing Anti-Money Laundering (AML) compliance with AI.

59. **Customer Onboarding**: Streamlining customer onboarding with AI.

60. **Cybersecurity**: Using AI to enhance cybersecurity in financial institutions.

61. **Robotic Process Automation (RPA)**: Implementing RPA for financial processes.

62. **Trade Surveillance**: Monitoring trading activities with AI.

63. **Customer Insights**: Gaining deeper customer insights with big data.

64. **Market Microstructure Analysis**: Using AI to analyze market microstructure.

65. **Payment Fraud Prevention**: Preventing payment fraud with AI.

66. **Financial Statement Analysis**: Automating the analysis of financial statements.

67. **Predictive Credit Analysis**: Enhancing credit analysis with predictive modeling.

68. **Financial News Analysis**: Using AI to analyze financial news impact.

69. **Investment Research**: Conducting investment research with AI.

70. **Big Data Analytics Platforms**: Developing big data analytics platforms for finance.

71. **Banking Customer Experience**: Enhancing customer experience in banking with AI.

72. **Risk Scoring Models**: Improving risk scoring models with ML.

73. **Financial Data Lakes**: Creating financial data lakes for comprehensive analysis.

74. **Real-Time Market Data**: Analyzing real-time market data with AI.

75. **Asset Management**: Using AI in asset management strategies.

76. **Financial Anomaly Detection**: Detecting financial anomalies with big data.

77. **Quant Funds**: Developing quant funds using AI algorithms.

78. **Regulatory Intelligence**: Gaining regulatory intelligence with AI.

79. **Financial Health Monitoring**: Monitoring financial health with AI tools.

80. **Blockchain Technology**: Leveraging blockchain for secure financial transactions.

81. **Customer Behavior Analysis**: Analyzing customer behavior with AI.

82. **Financial Decision Support**: Providing AI-driven financial decision support.

83. **Predictive Maintenance in ATMs**: Using AI for predictive maintenance of ATMs.

84. **Smart Contracts**: Implementing smart contracts in financial services.

85. **Ethical Investing**: Using AI to identify ethical investment opportunities.

86. **Financial Risk Forecasting**: Forecasting financial risks with big data.

87. **Investment Risk Analysis**: Conducting investment risk analysis with AI.

88. **Financial Chatbots**: Deploying financial chatbots for customer interaction.

89. **Behavioral Segmentation**: Segmenting customers based on behavior with ML.

90. **Market Intelligence**: Gaining market intelligence with big data analytics.

91. **Customer Feedback Analysis**: Analyzing customer feedback with AI.

92. **Financial Ecosystems**: Creating financial ecosystems with big data.

93. **AI in Wealth Management**: Using AI for wealth management services.

94. **Regulatory Compliance Monitoring**: Monitoring compliance with AI tools.

95. **Credit Portfolio Optimization**: Optimizing credit portfolios with AI.

96. **Data Governance**: Implementing data governance in financial services.

97. **Financial Product Development**: Developing financial products with AI insights.

98. **AI-Driven Market Research**: Conducting market research with AI.

99. **Big Data Warehousing**: Creating big data warehouses for finance.

100. **Predictive Loan Default**: Predicting loan defaults with ML.

101. **Financial Ecosystem Integration**: Integrating financial ecosystems with AI and big data.

**Summary**

AI, ML, and Big Data are transforming financial analysis by providing advanced tools for data analysis, risk management, and personalized services. These technologies are driving innovation in Fintech and facilitating digital transformation within financial institutions. The integration of these tools offers significant opportunities for making money, achieving passive income, and attaining financial freedom.

**Conclusion**

The impact of AI, ML, and Big Data on financial analysis in 2024 is profound, offering numerous benefits and opportunities for growth. While there are challenges to address, the potential for improved efficiency, accuracy, and innovation makes these technologies indispensable in the finance sector. By embracing these advancements, financial institutions can stay competitive, enhance their services, and drive financial success.

**Thank You Very Much With Warm Gratitude**

Thank you for exploring the ways AI, ML, and Big Data are impacting financial analysis. With warm gratitude, we appreciate your interest and hope this comprehensive guide provides valuable insights into the future of finance.

No comments:

Post a Comment