101 Advantages of Passive Income in 2024

### Introduction

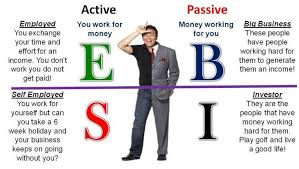

Passive income is the earnings derived from investments, properties, or other sources in which the earner is not actively involved on a day-to-day basis. In 2024, the pursuit of passive income has gained significant traction as people seek financial independence and a better work-life balance. This guide explores the 101 advantages of passive income, highlighting its importance, benefits, and potential drawbacks.

### Importance

The importance of passive income lies in its ability to provide financial stability and freedom. It allows individuals to diversify their income streams, reduce dependency on a single job, and create a buffer against economic uncertainties. In a rapidly changing world, passive income is an essential component of a robust financial strategy.

### Objective

The objective of this guide is to provide a comprehensive understanding of the benefits of passive income in 2024. It aims to educate and inspire individuals to explore various passive income opportunities to enhance their financial security and quality of life.

### Overviews

1. **Types of Passive Income**: Includes rental income, dividends, interest, royalties, and business income.

2. **Sources**: Real estate, stock market, peer-to-peer lending, intellectual property, and online businesses.

3. **Strategies**: Investment in diverse assets, automation, leveraging technology, and financial planning.

### Psychology

Understanding the psychology behind passive income is crucial for making informed decisions. Key psychological aspects include:

- **Risk Tolerance**: Passive income often involves initial investments; understanding one's risk tolerance is essential.

- **Delayed Gratification**: Many passive income sources require time to mature.

- **Financial Discipline**: Consistent investment and reinvestment are necessary.

- **Entrepreneurial Mindset**: Openness to new opportunities and innovation.

### Pros

1. **Financial Freedom**: Provides regular income without active involvement.

2. **Increased Cash Flow**: Steady cash flow enhances financial stability.

3. **Debt Reduction**: Extra income can be used to pay off debts.

4. **Savings and Investments**: Boosts savings and investment potential.

5. **Retirement Security**: Enhances retirement funds.

6. **Emergency Fund**: Builds a robust emergency fund.

7. **Wealth Building**: Contributes to long-term wealth.

8. **Tax Advantages**: Certain passive income sources offer tax benefits.

9. **Time Flexibility**: More time for personal and leisure activities.

10. **Work-Life Balance**: Reduces dependence on active employment.

### Cons

1. **Initial Investment**: Often requires significant upfront capital.

2. **Time to Mature**: Passive income streams can take time to become substantial.

3. **Market Risk**: Susceptible to market fluctuations.

4. **Maintenance**: Some passive income sources require periodic maintenance.

5. **Regulatory Changes**: Changes in laws and regulations can impact returns.

6. **Complexity**: Requires knowledge and strategic planning.

7. **Opportunity Cost**: Funds tied up in passive income projects cannot be used elsewhere.

8. **Risk of Loss**: Potential for loss if investments perform poorly.

9. **Economic Factors**: Economic downturns can affect passive income sources.

10. **Limited Control**: Less control over investment outcomes compared to active income.

Passive income, which involves earning money with minimal ongoing effort, offers numerous benefits that can significantly enhance financial stability and personal freedom.

Here are 101 advantages of generating passive income in 2024:

Financial Freedom

- Increased Cash Flow: Regular income without continuous effort.

- Financial Stability: Provides a steady income stream.

- Debt Reduction: Extra income to pay off debts faster.

- Savings Boost: More funds available for savings.

- Investment Opportunities: Extra cash for investment.

- Retirement Fund: Enhances retirement savings.

- Emergency Fund: Ability to build a robust emergency fund.

- Wealth Building: Contributes to long-term wealth accumulation.

- Tax Benefits: Potential tax advantages depending on the source.

- Economic Buffer: Protection against economic downturns.

Time Flexibility

- Work-Life Balance: More time for personal activities.

- Family Time: Spend more time with family.

- Hobbies and Interests: Pursue personal interests and hobbies.

- Travel Opportunities: Freedom to travel without work constraints.

- Reduced Stress: Less stress compared to active income sources.

- Flexible Schedule: Ability to set your own schedule.

- Retirement Possibility: Potential to retire early.

- Pursue Passions: Focus on passions without financial pressure.

- Less Burnout: Lower risk of job burnout.

- Health Benefits: More time for exercise and health maintenance.

Diversification

- Multiple Income Streams: Reduces dependency on a single income source.

- Risk Management: Spreads financial risk across various sources.

- Financial Security: Enhances overall financial security.

- Income Stability: Income continues despite job loss or illness.

- Economic Resilience: Better resilience during economic fluctuations.

- Wealth Diversification: Diversifies types of investments.

- Market Independence: Less reliant on market conditions.

- Sector Diversity: Income from various sectors and industries.

- Geographic Diversity: Potential to earn from global sources.

- Inflation Protection: Some passive income sources can hedge against inflation.

Personal Growth

- Skill Development: Learn new skills through passive income ventures.

- Entrepreneurial Experience: Gain entrepreneurial experience.

- Increased Confidence: Build confidence through successful ventures.

- Financial Literacy: Improve financial management skills.

- Networking Opportunities: Connect with other investors and entrepreneurs.

- Knowledge Expansion: Learn about different industries and markets.

- Sense of Achievement: Satisfaction from creating income sources.

- Creative Outlet: Opportunity to monetize creative ideas.

- Self-Discipline: Develop discipline in managing multiple income streams.

- Leadership Skills: Enhance leadership skills through passive income projects.

Lifestyle Improvements

- Improved Quality of Life: Better overall living standards.

- Home Ownership: Easier path to home ownership.

- Education Funding: Funds available for education and learning.

- Philanthropy: Ability to support charitable causes.

- Leisure Activities: More time and money for leisure activities.

- Home Upgrades: Ability to afford home improvements.

- Luxury Purchases: Capability to make luxury purchases.

- Personal Development: Funds for personal development courses.

- Stress Reduction: Less financial stress leads to better health.

- Peace of Mind: Financial security brings peace of mind.

Investment Benefits

- Compound Growth: Ability to reinvest passive income for compound growth.

- Real Estate Investment: Opportunities in rental properties.

- Stock Dividends: Earnings from dividend-paying stocks.

- Interest Income: Earnings from interest on investments.

- Capital Appreciation: Potential for capital gains.

- Portfolio Growth: Steady portfolio growth through reinvestment.

- Diversified Assets: Spread investments across different assets.

- Reduced Investment Risk: Balance risk with stable income sources.

- Long-Term Wealth: Build long-term wealth through consistent earnings.

- Investment Flexibility: More options to explore diverse investments.

Business Advantages

- Entrepreneurial Ventures: Start and grow businesses.

- Scalability: Scale income streams without proportional effort increase.

- Automation: Use automation to manage income streams.

- Business Ownership: Own and profit from multiple businesses.

- Low Maintenance: Minimal ongoing effort once set up.

- Franchising: Income from franchise ownership.

- Digital Products: Revenue from online products or services.

- Intellectual Property: Earnings from royalties and licensing.

- Subscription Models: Steady income from subscription services.

- E-commerce: Profits from online sales platforms.

Technological Integration

- Online Platforms: Leverage online platforms for passive income.

- Mobile Apps: Use mobile apps to manage income streams.

- Digital Marketing: Utilize digital marketing for business growth.

- Automation Tools: Tools for automating tasks and operations.

- Global Reach: Access to a global market.

- Minimal Overhead: Low operational costs for digital businesses.

- Scalable Infrastructure: Use cloud services for scalability.

- Data Analytics: Data-driven decisions to optimize income streams.

- Social Media: Monetize social media presence.

- Content Creation: Earnings from blogs, videos, and other content.

Retirement Benefits

- Early Retirement: Potential to retire earlier than planned.

- Supplemental Income: Additional income during retirement.

- Security in Retirement: Enhanced financial security.

- Retirement Lifestyle: Support for a comfortable retirement lifestyle.

- Healthcare Costs: Funds to cover healthcare expenses.

- Legacy Building: Ability to leave a financial legacy.

- Estate Planning: More assets to include in estate planning.

- Passive Income Portfolio: Diversified retirement income sources.

- Long-term Care: Funds available for long-term care.

- Travel in Retirement: Freedom to travel during retirement.

Psychological and Social Benefits

- Stress-Free Living: Reduced financial stress.

- Personal Satisfaction: Satisfaction from financial independence.

- Community Contribution: More resources to contribute to the community.

- Role Model: Be a financial role model for others.

- Increased Happiness: Higher levels of happiness due to financial freedom.

- Freedom of Choice: Greater freedom to make life choices.

- Social Connections: Meet like-minded individuals.

- Philanthropic Impact: Ability to make a larger impact through donations.

- Mentorship Opportunities: Mentor others on financial independence.

- Generational Wealth: Create and pass down generational wealth.

- Personal Fulfillment: Overall sense of personal fulfillment and accomplishment.

### Summary

Passive income is a powerful financial strategy that offers numerous benefits, including financial freedom, increased cash flow, and enhanced retirement security. However, it also comes with challenges such as initial investment requirements, market risks, and the need for ongoing management. Understanding these aspects helps individuals make informed decisions and maximize the advantages of passive income.### Conclusion

In 2024, passive income remains a critical component of financial planning. By diversifying income streams and leveraging technology, individuals can achieve greater financial security and independence. Despite its challenges, the benefits of passive income far outweigh the drawbacks, making it a valuable pursuit for those seeking long-term financial stability and a better quality of life. Passive income in 2024 presents numerous advantages that can lead to enhanced financial security, personal freedom, and overall quality of life. By diversifying income streams and leveraging modern technologies, individuals can achieve financial independence and create a stable, prosperous future. These benefits highlight the value of investing time and effort into establishing passive income sources to enjoy the myriad advantages they offer.

Thank You Very Much With Warm Gratitude

Passive income is a powerful financial strategy that offers numerous benefits, including financial freedom, increased cash flow, and enhanced retirement security. However, it also comes with challenges such as initial investment requirements, market risks, and the need for ongoing management. Understanding these aspects helps individuals make informed decisions and maximize the advantages of passive income.

### Conclusion

In 2024, passive income remains a critical component of financial planning. By diversifying income streams and leveraging technology, individuals can achieve greater financial security and independence. Despite its challenges, the benefits of passive income far outweigh the drawbacks, making it a valuable pursuit for those seeking long-term financial stability and a better quality of life. Passive income in 2024 presents numerous advantages that can lead to enhanced financial security, personal freedom, and overall quality of life. By diversifying income streams and leveraging modern technologies, individuals can achieve financial independence and create a stable, prosperous future. These benefits highlight the value of investing time and effort into establishing passive income sources to enjoy the myriad advantages they offer.

Thank You Very Much With Warm Gratitude

No comments:

Post a Comment