101 Ways AI is Transforming Finance Applications of AI & ML in Finance Future of AI & ML in the Finance Industry in 2024

Introduction

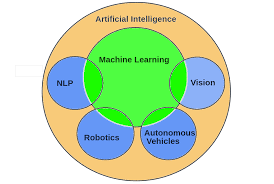

Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront of technological advancements, significantly transforming the finance industry. By leveraging vast amounts of data and sophisticated algorithms, AI and ML enhance decision-making, improve efficiency, and offer innovative solutions across various financial sectors, from trading and risk management to customer service and regulatory compliance.

Importance

The importance of AI and ML in finance cannot be overstated. These technologies provide several crucial benefits:

- Enhanced Decision-Making: AI and ML algorithms analyze complex data sets, providing insights that lead to better investment decisions, risk management, and financial planning.

- Operational Efficiency: Automation of routine tasks reduces operational costs and frees up human resources for more strategic roles.

- Improved Customer Experience: AI-driven tools offer personalized services, improve customer interactions, and streamline financial processes.

- Regulatory Compliance: AI ensures adherence to regulatory requirements and enhances the accuracy of compliance reporting.

Pros

- Increased Accuracy: AI models can process and analyze large volumes of data with high accuracy, leading to more precise predictions and assessments.

- Cost Savings: Automation reduces the need for manual intervention, cutting down operational costs.

- Enhanced Speed: AI systems can perform tasks and make decisions much faster than human counterparts.

- Personalization: AI allows for highly personalized financial products and services tailored to individual customer needs.

- Fraud Detection: Advanced algorithms detect and prevent fraudulent activities more effectively.

Cons

- High Implementation Costs: Developing and deploying AI systems can be expensive, particularly for smaller institutions.

- Data Privacy Concerns: The use of AI involves handling sensitive data, raising concerns about privacy and security.

- Bias and Fairness Issues: AI models can inadvertently perpetuate biases present in historical data, leading to unfair outcomes.

- Dependence on Data Quality: The effectiveness of AI is heavily reliant on the quality and accuracy of the data used.

- Job Displacement: Automation may lead to the displacement of jobs, impacting employment within the financial sector.

Challenges

- Data Privacy and Security: Ensuring the security of sensitive financial data and maintaining compliance with privacy regulations.

- Algorithmic Bias: Addressing and mitigating biases in AI algorithms to prevent discriminatory practices.

- Integration with Legacy Systems: Integrating AI technologies with existing legacy systems can be complex and costly.

- Regulatory Uncertainty: Navigating evolving regulations and standards related to AI and ML in finance.

- Talent Shortage: Finding skilled professionals with expertise in AI and finance can be challenging.

Techniques

- Natural Language Processing (NLP): Used for analyzing financial texts, news, and customer interactions to extract valuable insights.

- Predictive Analytics: Employs statistical algorithms and machine learning techniques to predict future financial trends and behaviors.

- Deep Learning: Advanced neural networks that improve the accuracy of predictions and classifications.

- Reinforcement Learning: AI systems learn optimal trading strategies by interacting with the market environment.

- Anomaly Detection: Identifies unusual patterns in financial data to detect fraud or operational issues.

Opportunities

- Enhanced Personalization: Leveraging AI to offer tailored financial products and services based on individual customer profiles.

- Advanced Risk Management: Utilizing AI to develop more sophisticated models for assessing and managing financial risks.

- Improved Compliance Solutions: Developing AI-driven tools for more efficient and accurate regulatory compliance.

- New Financial Products: Innovation in creating new financial products and services enabled by AI capabilities.

- Global Market Expansion: AI facilitates better decision-making and market analysis, enabling financial institutions to expand into new regions.

Artificial Intelligence (AI) and Machine Learning (ML) have been reshaping the finance industry for several years, and their impact continues to grow as technology advances. Below is a comprehensive overview of how AI is transforming finance, current applications, and potential future developments in 2024.

101 Ways AI is Transforming Finance

- Automated Trading: AI algorithms analyze vast amounts of data to execute trades at optimal times, improving returns.

- Fraud Detection: AI systems detect unusual transaction patterns to identify and prevent fraud.

- Credit Scoring: Machine learning models evaluate creditworthiness more accurately than traditional methods.

- Risk Management: AI assesses market risks and predicts financial downturns, helping mitigate risk.

- Customer Service Chatbots: AI-driven chatbots provide instant customer support and handle inquiries.

- Robo-Advisors: Automated platforms offer personalized investment advice and portfolio management.

- Sentiment Analysis: Analyzing social media and news sentiment to gauge market sentiment and make informed decisions.

- Predictive Analytics: AI predicts market trends, consumer behavior, and economic shifts.

- Regulatory Compliance: Automating compliance processes to ensure adherence to regulations.

- Fraud Prevention in Insurance: Detecting fraudulent claims using pattern recognition.

- Loan Underwriting: Streamlining the loan approval process with AI-driven evaluations.

- Algorithmic Trading: Using AI for high-frequency trading strategies.

- Portfolio Management: AI tools optimize asset allocation and rebalancing.

- Market Forecasting: AI models predict stock prices and market movements.

- Personal Finance Management: AI apps track expenses and provide financial advice.

- KYC (Know Your Customer): Automating identity verification processes.

- AML (Anti-Money Laundering): AI systems detect and report suspicious transactions.

- Customer Insights: Analyzing customer data to improve product offerings and personalization.

- Financial Advisory: Virtual advisors offering financial planning and guidance.

- Revenue Forecasting: Predicting future revenue based on historical data.

- Cost Optimization: Identifying areas to reduce operational costs using data analysis.

- Loan Default Prediction: Predicting the likelihood of loan defaults to mitigate risks.

- Insurance Pricing: AI models calculate premiums based on risk assessment.

- Speech Recognition: Voice-activated banking services for transactions and inquiries.

- Text Analytics: Analyzing documents and extracting valuable financial insights.

- Blockchain Integration: AI optimizing blockchain transactions and contracts.

- Investor Sentiment Analysis: Gauging investor mood to predict market shifts.

- Supply Chain Finance: Optimizing supply chain operations and financing.

- Payment Fraud Detection: Identifying fraudulent credit card transactions.

- Smart Contracts: Automating contract execution with AI-driven validation.

- Trade Finance Optimization: Streamlining international trade finance processes.

- Micro-Investing Platforms: AI-based platforms for investing small amounts.

- Financial News Analysis: Real-time analysis of news for market impact.

- AI-Driven Hedge Funds: Funds using AI for investment strategies.

- Cybersecurity: Protecting financial data from cyber threats using AI.

- Insurance Claims Processing: Automating claims assessment and approval.

- Wealth Management: AI tools for personalized wealth management advice.

- Data Privacy: Ensuring customer data protection and privacy compliance.

- Cash Flow Forecasting: Predicting cash flow needs for businesses.

- Real Estate Investment Analysis: AI tools for property valuation and investment analysis.

- Investor Risk Profiling: Understanding investor risk preferences for tailored advice.

- Chatbot-Assisted Banking: Interactive AI chatbots for seamless banking experiences.

- Real-Time Analytics: Instant analysis of financial data for decision-making.

- Enhanced Due Diligence: Streamlining due diligence with AI insights.

- Banking Automation: AI-driven automation of routine banking tasks.

- Quantitative Trading: Developing complex quantitative trading models.

- Customer Retention: Predicting churn and implementing retention strategies.

- Voice Biometrics: Secure authentication using voice recognition.

- ESG Investing: AI analysis of environmental, social, and governance factors.

- Tax Compliance: Automating tax calculations and compliance checks.

- Investment Screening: Identifying potential investments using AI criteria.

- Loan Repayment Prediction: Forecasting repayment likelihoods for better lending decisions.

- Investment Risk Assessment: AI-driven risk evaluation for investments.

- Cross-Selling Opportunities: Identifying products for cross-selling to customers.

- Financial Health Monitoring: AI apps providing insights into personal financial health.

- Debt Collection: Optimizing debt recovery strategies with AI.

- Market Basket Analysis: Understanding customer purchasing patterns.

- AI-Enhanced Trading Platforms: Platforms offering AI tools for traders.

- Financial Anomaly Detection: Identifying irregularities in financial data.

- Capital Market Insights: AI models providing insights into capital markets.

- Peer-to-Peer Lending: AI-driven platforms connecting lenders and borrowers.

- Insurance Risk Modeling: Accurate risk models for insurance underwriting.

- Trading Signal Generation: AI generates buy/sell signals for traders.

- Behavioral Finance Analysis: Understanding investor behavior using AI.

- Smart Portfolio Rebalancing: AI-driven automatic portfolio adjustments.

- Blockchain Fraud Detection: Ensuring security in blockchain transactions.

- Private Equity Analysis: AI tools for private equity investment evaluation.

- Derivatives Pricing: AI models calculating derivatives pricing.

- Corporate Finance Advisory: AI-driven insights for corporate finance decisions.

- Currency Exchange Forecasting: Predicting currency fluctuations.

- Insurtech Innovations: AI-driven innovations in the insurance industry.

- Customer Segmentation: Identifying customer segments for targeted marketing.

- Real-Time Market Monitoring: AI systems providing live market updates.

- Investment Diversification: AI tools for optimizing portfolio diversification.

- Algorithmic Asset Allocation: Automated asset allocation based on AI models.

- Robotic Process Automation: Automating repetitive financial tasks.

- Financial Data Integration: Combining data sources for comprehensive analysis.

- RegTech Solutions: AI-driven regulatory technology for compliance.

- Fintech Innovations: AI innovations in financial technology solutions.

- Personalized Marketing: AI-targeting marketing campaigns based on preferences.

- Mortgage Application Automation: Streamlining mortgage processes with AI.

- Peer Analysis: Analyzing financial performance relative to peers.

- Sentiment-Driven Trading: Trading strategies based on sentiment analysis.

- Liquidity Management: Optimizing liquidity with AI insights.

- Corporate Governance Analysis: Assessing governance practices with AI.

- AI-Driven Mergers and Acquisitions: Analyzing M&A opportunities with AI.

- Quantitative Risk Modeling: Advanced risk models for quantitative analysis.

- Financial Text Mining: Extracting insights from financial documents.

- Regulatory Reporting: Automating reporting for regulatory compliance.

- Portfolio Stress Testing: Simulating stress scenarios for portfolios.

- Expense Management: AI tools for managing and reducing expenses.

- Pension Fund Optimization: Enhancing pension fund performance with AI.

- Cross-Border Payments: Streamlining international payments with AI.

- Personalized Financial Education: AI platforms for customized learning.

- Insurance Product Development: Creating new insurance products with AI insights.

- Financial Statement Analysis: Automating analysis of financial statements.

- Market Sentiment Indices: Developing sentiment indices for investment insights.

- Digital Identity Verification: Enhancing identity verification with AI.

- AI-Driven IPO Analysis: Evaluating initial public offerings with AI.

- Revenue Leak Detection: Identifying potential revenue losses.

- Blockchain Auditing: AI tools for auditing blockchain transactions.

Current Applications of AI & ML in Finance

1. Trading and Investment

- Algorithmic Trading: Using AI to execute trades based on predefined criteria.

- Robo-Advisors: Platforms like Betterment and Wealthfront offer automated investment services.

- Predictive Analytics: AI models predict stock prices and economic trends.

2. Risk Management

- Credit Risk Assessment: AI evaluates borrower creditworthiness for lending decisions.

- Fraud Detection: AI systems identify and prevent fraudulent activities.

- Market Risk Analysis: AI assesses potential market risks and provides insights.

3. Customer Experience

- Chatbots: AI-powered chatbots handle customer inquiries and provide support.

- Personalized Financial Advice: AI platforms offer tailored financial advice to customers.

4. Compliance and Regulation

- RegTech: AI solutions ensure regulatory compliance and streamline reporting.

- AML and KYC: Automating anti-money laundering and customer verification processes.

5. Insurance

- Claim Processing: AI automates the assessment and approval of insurance claims.

- Fraud Detection: Identifying fraudulent claims using AI-driven analysis.

Future of AI & ML in the Finance Industry in 2024

1. Increased Automation

AI and ML will continue to automate routine tasks, improving efficiency and reducing costs. This includes further advancements in areas such as:

- Loan Processing: Faster and more accurate loan approvals.

- Risk Assessment: More sophisticated models for assessing various risks.

2. Advanced Predictive Analytics

- Market Forecasting: Improved accuracy in predicting market trends and economic shifts.

- Consumer Behavior Analysis: Deeper insights into consumer preferences and behavior.

3. Enhanced Cybersecurity

- Real-time Threat Detection: AI systems provide instant detection of cyber threats.

- Fraud Prevention: More robust systems for detecting and preventing fraud.

4. Personalization and Customer Engagement

- Hyper-Personalized Services: AI offers highly personalized financial products and advice.

- Improved Customer Interaction: AI-powered virtual assistants and chatbots offer more human-like interactions.

5. Regulatory Technology (RegTech)

- Automated Compliance: AI ensures real-time compliance with regulations.

- Regulatory Reporting: Streamlined reporting processes using AI tools.

6. Integration with Emerging Technologies

- Blockchain and AI: Enhanced transparency and security in transactions.

- IoT and AI: Leveraging IoT data for financial insights and services.

7. Sustainability and ESG

- ESG Analysis: AI-driven analysis of environmental, social, and governance factors for investment decisions.

- Sustainable Finance: AI tools promoting sustainable investment practices.

8. Ethical AI Practices

- Fairness and Transparency: Developing AI systems that are fair, transparent, and accountable.

- Bias Mitigation: Addressing biases in AI models to ensure equitable outcomes.

Conclusion

AI and ML are set to revolutionize the finance industry even further in 2024, driving innovation, efficiency, and personalization. As these technologies continue to evolve, financial institutions must embrace these changes to remain competitive and meet the growing expectations of customers and regulators. The future of finance is poised to be more automated, data-driven, and customer-centric, with AI at the forefront of this transformation.

A structured overview of AI in finance for 2024, including an introduction, importance, pros, cons, challenges, techniques, opportunities, and a conclusion

Thank You

Thank you for exploring the transformative impact of AI and ML in the finance industry. As these technologies continue to evolve, they hold the potential to redefine financial services, enhance operational efficiency, and provide unprecedented insights. Embracing these innovations responsibly will pave the way for a more dynamic and equitable financial landscape.

This overview captures the critical aspects of AI and ML in finance, highlighting their significance, benefits, drawbacks, and future potential.A structured overview of AI in finance for 2024, including an introduction, importance, pros, cons, challenges, techniques, opportunities, and a conclusion