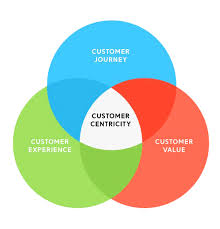

101 strategic steps to Insurers are transforming to achieve customer-centricity and elevate purpose in 2024

### Introduction

In 2024, the insurance industry is undergoing significant transformation, driven by the need to become more customer-centric and purpose-driven. As customer expectations evolve and digital innovations reshape the landscape, insurers are rethinking their strategies to better meet the needs of their clients. This guide outlines 101 strategic steps for insurers to achieve customer-centricity and elevate their purpose in 2024.

### Overview

To thrive in a rapidly changing environment, insurers must focus on enhancing customer experiences, leveraging technology, and aligning their operations with a broader social purpose. These 101 strategic steps encompass a range of initiatives, from improving customer service and using advanced analytics to fostering a culture of innovation and sustainability.

### 101 Strategic Steps to Achieve Customer-Centricity and Elevate Purpose

1. **Customer Journey Mapping**: Analyze and map the entire customer journey to identify pain points and opportunities for improvement.

2. **Personalized Communication**: Use data to tailor communications to individual customer preferences and needs.

3. **Omnichannel Support**: Provide consistent and seamless support across multiple channels, including phone, email, chat, and social media.

4. **Mobile Optimization**: Ensure all digital services are optimized for mobile devices to enhance accessibility and convenience.

5. **Customer Feedback Loops**: Implement mechanisms to regularly collect and act on customer feedback.

6. **AI-Driven Customer Insights**: Use artificial intelligence to gain deeper insights into customer behavior and preferences.

7. **Proactive Customer Service**: Anticipate customer needs and address issues before they become problems.

8. **Customer-Centric Culture**: Foster a company culture that prioritizes customer satisfaction at all levels.

9. **Simplified Products**: Develop clear and easy-to-understand insurance products.

10. **Self-Service Options**: Expand self-service capabilities to empower customers to manage their policies online.

11. **Transparent Pricing**: Ensure pricing is transparent and easily understandable.

12. **Claims Process Improvement**: Streamline the claims process to make it faster and more efficient.

13. **Loyalty Programs**: Create loyalty programs that reward long-term customers.

14. **Customer Education**: Provide educational resources to help customers understand their insurance options.

15. **Social Media Engagement**: Actively engage with customers on social media platforms.

16. **Customer Advocacy Programs**: Develop programs that encourage satisfied customers to become brand advocates.

17. **Data Privacy and Security**: Prioritize data privacy and security to build customer trust.

18. **Customer-Centric KPIs**: Establish key performance indicators focused on customer satisfaction and experience.

19. **Voice of the Customer Programs**: Implement programs to capture and analyze customer feedback and sentiment.

20. **Real-Time Assistance**: Offer real-time assistance through chatbots and live chat.

21. **Community Involvement**: Engage in community initiatives that resonate with your customer base.

22. **Customer Experience Management Software**: Invest in software to manage and enhance customer experiences.

23. **Employee Training**: Train employees on customer-centric practices and empathy.

24. **Diversity and Inclusion**: Promote diversity and inclusion within the company to better reflect the customer base.

25. **Sustainability Initiatives**: Integrate sustainability into business practices to align with customer values.

26. **Ethical Practices**: Ensure all business practices are ethical and transparent.

27. **Innovative Product Offerings**: Develop innovative insurance products that address emerging risks and customer needs.

28. **Partnerships and Collaborations**: Partner with other organizations to offer comprehensive solutions to customers.

29. **Health and Wellness Programs**: Offer programs that support customers’ health and well-being.

30. **Financial Literacy Programs**: Provide financial literacy resources to help customers make informed decisions.

31. **Inclusive Insurance Products**: Create products that cater to underserved or marginalized groups.

32. **Digital Transformation**: Invest in digital transformation to enhance efficiency and customer experience.

33. **Blockchain Technology**: Utilize blockchain to improve transparency and security in transactions.

34. **Usage-Based Insurance**: Offer usage-based insurance products that provide flexibility and cost savings.

35. **Telematics**: Use telematics to offer personalized insurance products based on customer behavior.

36. **AI-Powered Underwriting**: Implement AI-powered underwriting to improve accuracy and efficiency.

37. **Predictive Analytics**: Use predictive analytics to anticipate customer needs and trends.

38. **Behavioral Economics**: Apply principles of behavioral economics to design better products and communications.

39. **Gamification**: Use gamification to engage customers and promote healthy behaviors.

40. **Virtual Reality**: Explore virtual reality to provide immersive customer experiences.

41. **Internet of Things (IoT)**: Integrate IoT devices to offer real-time risk management solutions.

42. **Dynamic Pricing Models**: Implement dynamic pricing models that adjust based on real-time data.

43. **Digital Wallets**: Enable digital wallet payments for convenience and speed.

44. **Microinsurance**: Offer microinsurance products for specific, short-term needs.

45. **AI Chatbots**: Deploy AI chatbots to handle routine inquiries and support.

46. **Robotic Process Automation (RPA)**: Use RPA to automate repetitive tasks and improve efficiency.

47. **Customer Success Teams**: Establish customer success teams focused on long-term customer satisfaction.

48. **Peer Reviews**: Incorporate peer reviews and ratings into the decision-making process.

49. **Scenario Planning**: Conduct scenario planning to anticipate and prepare for future risks.

50. **Sustainable Investing**: Offer investment options that prioritize sustainability.

51. **Climate Risk Assessment**: Assess and address climate-related risks in underwriting and investment.

52. **Behavioral Health Programs**: Support customers with behavioral health programs and resources.

53. **Virtual Health Services**: Partner with telehealth providers to offer virtual health services.

54. **Disaster Preparedness Programs**: Provide resources and support for disaster preparedness.

55. **Flexible Payment Options**: Offer flexible payment plans to accommodate customer needs.

56. **Accessibility Enhancements**: Ensure all digital and physical services are accessible to everyone.

57. **Customer-Centric Innovation Labs**: Create innovation labs focused on developing customer-centric solutions.

58. **Emotional Intelligence Training**: Train staff in emotional intelligence to improve customer interactions.

59. **Customer Co-Creation**: Involve customers in the development of new products and services.

60. **Net Promoter Score (NPS)**: Regularly measure NPS to gauge customer loyalty and satisfaction.

61. **Customer-Centric Marketing**: Focus marketing efforts on addressing customer needs and pain points.

62. **Value-Added Services**: Offer additional services that provide value beyond insurance coverage.

63. **Responsive Web Design**: Ensure websites are responsive and user-friendly on all devices.

64. **Cloud Computing**: Use cloud computing to enhance scalability and flexibility.

65. **AI-Powered Fraud Detection**: Implement AI to detect and prevent fraudulent activities.

66. **Customer Lifecycle Management**: Manage the entire customer lifecycle to improve retention and satisfaction.

67. **Telematics-Driven Discounts**: Offer discounts based on telematics data to reward safe behavior.

68. **Customer Portals**: Develop comprehensive customer portals for easy policy management.

69. **AI-Powered Personalization**: Use AI to personalize interactions and recommendations.

70. **Real-Time Analytics**: Utilize real-time analytics to respond quickly to customer needs.

71. **Customer Advisory Boards**: Establish advisory boards to gather customer insights and feedback.

72. **Ethical AI Practices**: Ensure all AI applications are ethical and transparent.

73. **Sustainability Reporting**: Publish sustainability reports to demonstrate commitment to social responsibility.

74. **Emotional Support Services**: Offer emotional support services to customers during claims and crises.

75. **Disaster Recovery Assistance**: Provide robust disaster recovery assistance to affected customers.

76. **Employee Well-Being Programs**: Support employee well-being to improve customer service.

77. **Cross-Industry Partnerships**: Partner with other industries to offer integrated solutions.

78. **Customer-Centric Metrics**: Develop and track metrics that reflect customer-centric performance.

79. **Continuous Improvement Programs**: Implement programs for continuous improvement based on customer feedback.

80. **Digital Identity Verification**: Use digital identity verification for security and convenience.

81. **AI Ethics Committees**: Establish committees to oversee ethical AI usage.

82. **Sustainability Certifications**: Obtain certifications to validate sustainability efforts.

83. **Philanthropic Initiatives**: Engage in philanthropic initiatives that align with company values.

84. **Corporate Social Responsibility (CSR)**: Strengthen CSR programs to contribute positively to society.

85. **Community Resilience Programs**: Support community resilience through targeted programs and initiatives.

86. **Data-Driven Decision Making**: Use data analytics to inform strategic decisions.

87. **Customer Empowerment**: Empower customers with tools and resources to manage their risks.

88. **Holistic Risk Management**: Offer holistic risk management solutions that cover multiple aspects of life and business.

89. **Sustainable Supply Chain**: Ensure supply chain practices are sustainable and ethical.

90. **Circular Economy Initiatives**: Participate in initiatives that promote a circular economy.

91. **Environmental Impact Reduction**: Implement measures to reduce the environmental impact of operations.

92. **AI-Driven Marketing**: Use AI to optimize marketing campaigns and improve targeting.

93. **Voice Search Optimization**: Optimize digital content for voice search to enhance accessibility.

94. **Blockchain for Transparency**: Use blockchain technology to enhance transparency and trust in transactions.

95. **Sustainable Business Practices**: Adopt sustainable business practices across all operations.

96. **Ethical Sourcing**: Ensure all products and services are ethically sourced.

97. **Green Insurance Products**: Develop insurance products that support environmental sustainability.

98. **Customer Empowerment Programs**: Create programs that empower customers to make informed decisions.

99. **Sustainable Investment

Portfolios**: Offer investment portfolios that focus on sustainability.

100. **Virtual Events and Webinars**: Host virtual events and webinars to engage and educate customers.

101. **Customer-Centric Innovation Strategy**: Develop a comprehensive innovation strategy focused on enhancing customer experiences.

### Pros of Achieving Customer-Centricity and Elevating Purpose

1. **Increased Customer Loyalty**: Focusing on customer needs fosters loyalty and long-term relationships.

2. **Competitive Advantage**: A customer-centric approach differentiates insurers in a crowded market.

3. **Enhanced Reputation**: Aligning with social purpose improves brand reputation and public perception.

4. **Better Customer Insights**: A deep understanding of customer preferences leads to more effective strategies.

5. **Higher Customer Satisfaction**: Personalized and responsive services increase customer satisfaction.

6. **Increased Efficiency**: Streamlined processes and automation improve operational efficiency.

7. **Employee Engagement**: A purpose-driven mission can boost employee morale and engagement.

8. **Innovation**: Continuous focus on customer needs drives innovation and product development.

9. **Market Adaptability**: Being customer-centric helps insurers quickly adapt to changing market conditions.

10. **Social Impact**: Contributing positively to society enhances the company’s overall impact and legacy.

### Cons of Achieving Customer-Centricity and Elevating Purpose

1. **Initial Costs**: Implementing new technologies and processes can be expensive.

2. **Cultural Shift**: Shifting to a customer-centric culture can be challenging and time-consuming.

3. **Complexity**: Managing multiple channels and personalized services adds complexity to operations.

4. **Data Privacy Concerns**: Increased use of data analytics requires stringent data privacy measures.

5. **Continuous Adaptation**: Staying customer-centric requires ongoing adaptation and improvement.

6. **Regulatory Challenges**: Navigating regulatory requirements while implementing new strategies can be difficult.

7. **Resource Allocation**: Balancing resources between innovation, customer service, and other areas can be challenging.

8. **Technology Integration**: Integrating new technologies with existing systems may face hurdles.

9. **Customer Expectations**: Rising customer expectations can put pressure on maintaining high service levels.

10. **Short-Term Disruption**: Initial changes and implementations may cause short-term disruption to services.

### Conclusion

Transforming into a customer-centric and purpose-driven insurer in 2024 is a strategic imperative that can lead to significant benefits, including increased customer loyalty, enhanced reputation, and improved operational efficiency. While the journey involves challenges such as initial costs and cultural shifts, the long-term advantages far outweigh the cons. By following these 101 strategic steps, insurers can better meet the evolving needs of their customers, contribute positively to society, and secure a competitive edge in the market.

Thank you for considering these strategies, and may they guide you toward achieving customer-centricity and elevating your purpose in 2024.