101 Ways AI is Transforming, Blockchain, chat GPT, Cryptocurrency, Finance Applications of AI & ML in Finance Future of AI & ML in the Finance Industry in 2024

Certainly! Below is a detailed overview of how AI, blockchain, ChatGPT, and cryptocurrencies are transforming finance, including their current applications and future potential in 2024.

101 Ways AI is Transforming Finance

AI in Trading and Investment

- Algorithmic Trading: Automates trade execution based on complex algorithms.

- Robo-Advisors: Provides personalized investment advice and portfolio management.

- Market Prediction: Uses predictive analytics for stock price forecasting.

- Sentiment Analysis: Analyzes news and social media to gauge market sentiment.

- Quantitative Trading: Develops sophisticated trading strategies using AI.

- Portfolio Optimization: Assists in asset allocation and rebalancing.

AI in Risk Management

- Credit Scoring: Evaluates creditworthiness with advanced models.

- Fraud Detection: Identifies unusual patterns to prevent fraud.

- Market Risk Assessment: Predicts and mitigates potential market risks.

- Stress Testing: Simulates financial stress scenarios for risk evaluation.

- Insurance Risk Modeling: Enhances underwriting accuracy and pricing.

AI in Customer Service

- Chatbots: Provides instant support and handles customer inquiries.

- Voice Assistants: Uses speech recognition for banking transactions.

- Personalized Recommendations: Offers tailored financial advice.

- Customer Feedback Analysis: Analyzes feedback for service improvement.

AI in Regulatory Compliance

- AML and KYC Automation: Streamlines anti-money laundering processes.

- RegTech Solutions: Automates compliance reporting and monitoring.

- Data Privacy Management: Ensures adherence to data protection regulations.

AI in Operations and Efficiency

- Robotic Process Automation (RPA): Automates routine financial tasks.

- Document Processing: Uses AI for data extraction from financial documents.

- Expense Management: Optimizes expense tracking and reduction.

- Supply Chain Finance: Improves supply chain efficiency and financing.

AI in Cybersecurity

- Threat Detection: Identifies and responds to cybersecurity threats.

- Fraud Prevention: Protects against payment and transaction fraud.

- Biometric Security: Uses facial and voice recognition for authentication.

AI in Personal Finance

- Budgeting Apps: Provides insights into personal finance management.

- Debt Management Tools: Offers strategies for debt reduction.

- Savings Optimization: Recommends savings plans based on goals.

AI in Blockchain and Cryptocurrency

- Smart Contracts: Automates execution with AI-driven validation.

- Blockchain Analysis: Detects fraudulent activities on blockchain networks.

- Cryptocurrency Trading Bots: Uses AI for automated crypto trading.

- ICO Evaluation: Assesses initial coin offerings for investment potential.

- Decentralized Finance (DeFi): Enhances DeFi platforms with AI insights.

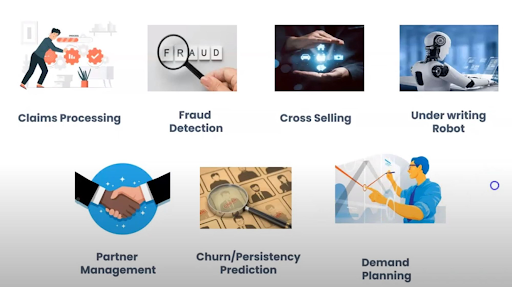

AI in Insurance

- Claims Processing: Automates assessment and approval of claims.

- Fraud Detection: Identifies fraudulent insurance claims.

- Policy Recommendations: Offers tailored insurance products.

AI in Banking

- Loan Underwriting: Streamlines approval processes with AI evaluations.

- Risk-Based Pricing: Adjusts loan rates based on AI risk assessments.

- Real-Time Analytics: Provides live insights into financial performance.

- Customer Segmentation: Identifies segments for targeted marketing.

AI in Corporate Finance

- Revenue Forecasting: Predicts future revenue trends.

- Cost Optimization: Identifies areas for cost reduction.

- Financial Health Monitoring: Analyzes corporate financial health.

AI in ESG (Environmental, Social, and Governance)

- ESG Analysis: Evaluates companies based on ESG criteria.

- Sustainable Investing: Provides insights into sustainable investment opportunities.

Blockchain and Its Impact on Finance

Blockchain Applications

- Decentralized Transactions: Facilitates peer-to-peer transactions without intermediaries.

- Immutable Records: Ensures secure and tamper-proof financial records.

- Smart Contracts: Executes agreements automatically when conditions are met.

- Cross-Border Payments: Streamlines international transactions with reduced fees.

- Supply Chain Transparency: Provides visibility into supply chain processes.

Blockchain in Cryptocurrency

- Cryptocurrency Platforms: Powers digital currencies like Bitcoin and Ethereum.

- Tokenization of Assets: Represents real-world assets on blockchain networks.

- Decentralized Finance (DeFi): Offers financial services without traditional banks.

Blockchain Security

- Enhanced Security: Protects data with cryptographic encryption.

- Fraud Prevention: Reduces risk of fraud through transparent transactions.

- Identity Verification: Provides secure and verifiable digital identities.

ChatGPT and Conversational AI

ChatGPT Applications in Finance

- Customer Support: Offers 24/7 assistance and handles complex inquiries.

- Financial Education: Provides information on financial products and concepts.

- Virtual Financial Advisors: Simulates human-like financial advice.

- Automated Reporting: Generates reports and summaries for financial analysis.

Benefits of ChatGPT

- Cost-Effective: Reduces the need for human customer service representatives.

- Scalable Support: Handles large volumes of inquiries simultaneously.

- Multilingual Capabilities: Supports communication in multiple languages.

Cryptocurrency and Digital Assets

Cryptocurrency Innovations

- Bitcoin and Ethereum: Leading digital currencies with wide adoption.

- Stablecoins: Cryptocurrencies pegged to fiat currencies for stability.

- Central Bank Digital Currencies (CBDCs): Digital currencies issued by central banks.

Cryptocurrency in Finance

- Investment Opportunities: Offers new avenues for portfolio diversification.

- Payment Solutions: Enables fast and secure payments globally.

- Smart Contract Platforms: Facilitates complex financial agreements.

Challenges in Cryptocurrency

- Regulatory Uncertainty: Navigating evolving regulations and compliance.

- Volatility: Managing risks associated with price fluctuations.

- Security Concerns: Protecting against hacking and cyber threats.

Finance Applications of AI & ML in 2024

Current Applications

- Automated Trading: AI algorithms executing trades based on data analysis.

- Credit Risk Management: AI models assessing borrower creditworthiness.

- Fraud Detection Systems: Identifying and preventing fraudulent transactions.

- Customer Insights: Analyzing data for personalized financial services.

- Regulatory Compliance: Ensuring adherence to financial regulations with AI tools.

Future Developments

- Enhanced Predictive Analytics: Improved accuracy in market trend forecasting.

- Advanced Personalization: AI-driven customization of financial products.

- AI-Driven Risk Assessment: More sophisticated models for risk management.

- Real-Time Data Analysis: Instant insights into financial markets and operations.

- Blockchain Integration: Enhanced transparency and security in transactions.

Future of AI & ML in the Finance Industry in 2024

Opportunities

- Global Market Expansion: AI facilitates better market analysis and decision-making.

- Sustainable Finance: Promotes sustainable investment practices with AI insights.

- Digital Transformation: Accelerates the adoption of digital technologies in finance.

- Fintech Innovations: AI drives the development of new financial technologies.

Challenges

- Data Privacy and Security: Ensuring the protection of sensitive financial data.

- Algorithmic Bias: Addressing biases in AI models for fair outcomes.

- Integration with Legacy Systems: Overcoming challenges in modernizing infrastructure.

- Regulatory Compliance: Navigating complex regulatory landscapes.

- Talent Shortage: Finding skilled professionals with AI and finance expertise.

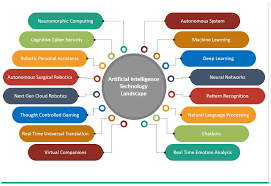

Techniques

- Natural Language Processing (NLP): Analyzing text for financial insights.

- Deep Learning: Using neural networks for improved predictions.

- Reinforcement Learning: Developing trading strategies through market interaction.

- Predictive Modeling: Forecasting market trends and consumer behavior.

- Anomaly Detection: Identifying irregularities in financial data.

Conclusion

- Embracing Innovation: Financial institutions must adopt AI and blockchain technologies to stay competitive.

- Balancing Risks and Rewards: Weighing the benefits of AI and ML against potential risks.

- Collaborative Efforts: Encouraging partnerships between financial institutions and tech companies.

- Regulatory Adaptation: Developing frameworks to support innovation while ensuring compliance.

- Future Prospects: The finance industry is poised for a dynamic and transformative future with AI, blockchain, and cryptocurrencies leading the way.

This overview captures the transformative impact of AI, blockchain, ChatGPT, and cryptocurrencies on the finance industry, highlighting their current applications, future potential, and challenges. These technologies will continue to drive innovation, efficiency, and personalization in financial services.

Thank You